zdr-journal.ru

Tools

Solar System Dealers Near Me

Signature Solar provides solar panels & components and full kits for off-grid, grid-tie and custom diy solar systems. Providing Solar and hands on. Locate a nearest V-Guard dealers, sellers, distributors and service centers in your locality. A leading brand for quality electrical appliances. Solar panels in New York for sale | Cost solar panels for business in New York | Buy the best solar panels online at best prices in New York | Save money. Solar Calculator · Dealer Locator. Know about Tata Power Solar, leading solar panel manufacturer in India. About Us · Our Heritage · Vision, Mission & Values. Outdoor Maps Golf Course Locator. Accessories & Plans. Accessories Apps Garmin Technology Integration Software Updates System Builder. Communities. Find your local Authorized Trojan Dealer. Since , Trojan Battery has revolutionized deep cycle battery technology by introducing generations of renowned. New York City, NY solar systems for residential properties. 35+ years of experience can get you the best in solar tech for your home. Click to find out. Panel weight (lb.) open arrow. Solar panel type. Close Stores|; © Home Depot|; Privacy & Security Statement|; Terms|; My. New York State Solar Panels, Solar Battery Storage + Energy Services. Affordable Home Solar Panels & Solar Battery Backup for New York Homeowners. Signature Solar provides solar panels & components and full kits for off-grid, grid-tie and custom diy solar systems. Providing Solar and hands on. Locate a nearest V-Guard dealers, sellers, distributors and service centers in your locality. A leading brand for quality electrical appliances. Solar panels in New York for sale | Cost solar panels for business in New York | Buy the best solar panels online at best prices in New York | Save money. Solar Calculator · Dealer Locator. Know about Tata Power Solar, leading solar panel manufacturer in India. About Us · Our Heritage · Vision, Mission & Values. Outdoor Maps Golf Course Locator. Accessories & Plans. Accessories Apps Garmin Technology Integration Software Updates System Builder. Communities. Find your local Authorized Trojan Dealer. Since , Trojan Battery has revolutionized deep cycle battery technology by introducing generations of renowned. New York City, NY solar systems for residential properties. 35+ years of experience can get you the best in solar tech for your home. Click to find out. Panel weight (lb.) open arrow. Solar panel type. Close Stores|; © Home Depot|; Privacy & Security Statement|; Terms|; My. New York State Solar Panels, Solar Battery Storage + Energy Services. Affordable Home Solar Panels & Solar Battery Backup for New York Homeowners.

We consider the following questions before allowing installers to join the EnergySage Marketplace. Solar panels with a rating local installers. However. Most common triggers are when homeowners look to add electric appliances such as heat pumps, Level 2 EV chargers, battery systems, solar panels, and even hot. Freedom from high utility bills through solar energy. Guaranteed power production. Get a free quote and find out how much you could save by going solar. Solar panels. Monitoring. Discover monitoring · icon for victronconnect Find a Victron Energy dealer near you. Where to buy. This site is powered by. Our solar installers in New York are the best in the business. Highly experienced and thoroughly trained, you can have confidence in their techniques and. Solar System Installers · Software. Product Directory. Solar Panels · Solar Local Seller · Newsletter · Excel Database · Newsletter Sign Up · Contact ENF. Safe and Energy-Efficient Residential Solar Solution. Maximizing the limited roof space to provide a continuous supply of green electricity. Embracing solar energy by opting for solar power installations has several benefits. With Justdial, you can search solar energy system dealers near me or solar. The #1 solar software to design and sell advanced PV systems. See why installers use Aurora to create over PV designs every week. Look for Luminous India stores with much ease. Unable to find Luminous Solar Systems with Battery (PWM) | Off Grid Solar Solutions · Hybrid Solar. Solar Battery Storage. Back to Main Menu Solar Battery Storage. About Solar © Generac Power Systems, Inc. All rights reserved. | Privacy Notice. NY Sun. Navigation menu. Solar for Your Home · Solar for Your Business · Communities & Local To learn more about the basics of solar energy, check out our. For those putting in a search for solar system dealers near me, these considerations serve as the foundation for a well-informed decision. Solar systems. Powerwall is a compact home battery that stores energy generated by solar or from the grid. You can use this energy to power the devices and appliances in. energy, transport, and utility infrastructure portfolios with a pan-India presence. Adani Solar is India's 1st and largest vertically integrated solar PV. Solar Energy Equipment and Systems - Dealers.” (Note that some of the Local building departments may also require the installer to have a general contractor's. We are the best Solar dealers in Kannur | Kerala. ENQUIRE NOW solar panel Solar Battery, and Water Purifier. We do solar panel distribution in Kannur. Dealers Locator. Why Choose Us. Nexus Solar Energy Pvt Ltd stands as the prime choice for all your solar needs. Backed by 16 years of expertise in battery. View our worldwide map of Victron Energy distributors and points of sale and find a Victron Energy dealer near you Solar CBI. Ashland. Solar Energy Systems. Signature Solar provides solar panels & components and full kits for off-grid, grid-tie and custom diy solar systems. Providing Solar and hands on.

Everything You Need To Know About Reverse Mortgages

To determine whether you qualify for a reverse mortgage, a lender will look • Before you Sign Any Contract: 10 Things you Need to Know. Notes. With. *The borrower must meet all loan obligations, including living in the property as the principal residence, maintaining the home, and paying property charges. Here's what to know about the potential risks, how reverse mortgages work, how to get the best deal for you, and how to report reverse mortgage fraud. Based on this value the bank will decide the maximum amount you can receive as a loan using your property. Most banks offer up to 80% of the value of the house. That could mean you (or your estate) must repay the loan to keep the property or sell the home to pay off the mortgage. Keep in mind that the reverse mortgage. You have cash you can use for living expenses, surprise bills, paying off debt or other financial concerns, You must repay the loan in full if you move out of. A reverse mortgage allows homeowners aged 55 and older to convert a portion of their home equity into tax-free cash. Unlike a traditional mortgage, you don't. Reverse mortgages let you gain access to your equity without the need to sell or relocate. This is a good alternative if you're planning to. The Reverse Mortgage Book: Everything You Need to Know Explained Simply: Holcomb, Cindy: Books - zdr-journal.ru To determine whether you qualify for a reverse mortgage, a lender will look • Before you Sign Any Contract: 10 Things you Need to Know. Notes. With. *The borrower must meet all loan obligations, including living in the property as the principal residence, maintaining the home, and paying property charges. Here's what to know about the potential risks, how reverse mortgages work, how to get the best deal for you, and how to report reverse mortgage fraud. Based on this value the bank will decide the maximum amount you can receive as a loan using your property. Most banks offer up to 80% of the value of the house. That could mean you (or your estate) must repay the loan to keep the property or sell the home to pay off the mortgage. Keep in mind that the reverse mortgage. You have cash you can use for living expenses, surprise bills, paying off debt or other financial concerns, You must repay the loan in full if you move out of. A reverse mortgage allows homeowners aged 55 and older to convert a portion of their home equity into tax-free cash. Unlike a traditional mortgage, you don't. Reverse mortgages let you gain access to your equity without the need to sell or relocate. This is a good alternative if you're planning to. The Reverse Mortgage Book: Everything You Need to Know Explained Simply: Holcomb, Cindy: Books - zdr-journal.ru

Reverse Mortgage Requirements · Age: You and any of your co-borrowers (a spouse, for example) need to be at least 62 years of age. · Home Equity: You must own. A reverse mortgage does not mean your expenses end: You must keep paying property tax and homeowners insurance or else you could face foreclosure. Other ways of. A reverse mortgage isn't for everyone. Before you apply, it's important to weigh the pros and cons of this loan, especially while considering how you want to. ost people have probably heard of reverse mortgage loans. but even though these loans have been getting more attention lately, it's. A reverse mortgage allows you to access tax-free cash from the value in your home without having to sell it. You can access up to 55% of the value of your home. A reverse mortgage is a financial tool available to seniors aged 62 and older who own their homes. It allows them to use their home equity as collateral to. A reverse mortgage is a loan specifically designed to help senior citizens (aged 60 years and above) use their self-occupied residential property as collateral. Reverse mortgages are different from regular mortgages or credit lines in that no payments are required until you no longer live in the property. You're in. How do I get a reverse mortgage? · An appraiser will determine the value of your home. · The lender will tell you how much you qualify for based on your age, the. The Federal Housing Administration backs one type of reverse mortgage, called a home equity conversion mortgage. FHA backing guarantees that you or your family. A reverse mortgage differs from a traditional mortgage in that the borrower does not make monthly loan payments; instead, the lender disburses payments to the. A reverse mortgage is a home loan that you do not have to pay back for as long as you live in your home. It can be paid to you in one lump sum, as a regular. A reverse mortgage is a loan that allows homeowners to access the equity that has been built up in their property and convert it into cash. Many mortgage lenders require a minimum of 50% equity to qualify you for the loan. Property maintenance: Borrowers must be able to maintain the property and pay. To qualify, you must be 62 or older and the home you are mortgaging must be your primary residence. If there is an outstanding traditional mortgage on your home. A reverse mortgage is a type of home loan that allows owners to turn their home equity into cash. With this type of mortgage, you don't make monthly payments. To learn more about your reverse mortgage, contact your mortgage servicer If you already have a reverse mortgage and need to understand relief options, a HUD-. A reverse mortgage is a mortgage loan, usually secured by a residential property, that enables the borrower to access the unencumbered value of the property. The Benefits of a Reverse Mortgage in Florida · You can stay in your home for as long as you want. · Funds from reverse mortgages are tax-exempt. · You'll have. With a reverse mortgage, the lender makes payments to you rather than the other way around. But these loans are risky and you need to avoid reverse mortgage.

Nationwide High Yield Savings

Open your account in minutes with as little as $ Our Panacea Checking Account is designed with you in mind with free ATM use nationwide, no overdraft fees. Impact Money Market · % Annual Percentage Yield* · $ to open · $25 monthly fee if balance falls below $5, We've found 9 savings accounts for you. Flex Regular Saver. Open online, and save up to £ a month for 12 months. Interest rate % AER/gross a year . Most checking accounts pay little to no interest. In fact, our High-Yield Checking (HYC) pays several times more than the nationwide average* APY (annual. Open your % APY* Connect High-Yield Checking account for as little as $1, and get access to great Debit rewards, with free ATM access nationwide, free. Axos Bank offers High Yield Savings. The account has no minimum balance requirement or monthly maintenance fee. Other features include. It is never too early to save for a rainy day or holidays. Find out how a savings account can help you get a jump on holiday gift-giving. Start today. High Yield Savings Account Sponsored Note: Interest compounds daily 4/23 - Nationwide By Axos Bank Savings Rate % [Not on DA Savings List]. Evergreen Bank offers a generous % APY on its high-yield savings account, with a minimum deposit requirement of $ With no monthly fees and no minimum. Open your account in minutes with as little as $ Our Panacea Checking Account is designed with you in mind with free ATM use nationwide, no overdraft fees. Impact Money Market · % Annual Percentage Yield* · $ to open · $25 monthly fee if balance falls below $5, We've found 9 savings accounts for you. Flex Regular Saver. Open online, and save up to £ a month for 12 months. Interest rate % AER/gross a year . Most checking accounts pay little to no interest. In fact, our High-Yield Checking (HYC) pays several times more than the nationwide average* APY (annual. Open your % APY* Connect High-Yield Checking account for as little as $1, and get access to great Debit rewards, with free ATM access nationwide, free. Axos Bank offers High Yield Savings. The account has no minimum balance requirement or monthly maintenance fee. Other features include. It is never too early to save for a rainy day or holidays. Find out how a savings account can help you get a jump on holiday gift-giving. Start today. High Yield Savings Account Sponsored Note: Interest compounds daily 4/23 - Nationwide By Axos Bank Savings Rate % [Not on DA Savings List]. Evergreen Bank offers a generous % APY on its high-yield savings account, with a minimum deposit requirement of $ With no monthly fees and no minimum.

High Yield Savings is a tiered savings account paying a variable dividend rate, that may change at any time, on the entire balance in your account. The saving products offered by NexBank exclusively through Raisin are available to savers nationwide and feature highly competitive rates. One of the highest dividend rates nationwide The Grow Money Market savings account offers no minimum balance fees, full access to your savings, and an. Nationwide access to surcharge-free MoneyPass® ATMs. Avoid the $1 This is a high-yield savings account plus added features that help you plan. All of our ranked high-yield savings accounts have no monthly maintenance fee, are protected by FDIC insurance and feature some of the highest interest rates. The Inspired Share Savings Account earns % APY* on balances less than $10,, and % APY* on balances of $10, or more. savings/savings-accounts-best-interest/. Upvote 8. Downvote Award Share Some of these high-interest instant access, often classified as. If you're looking for the best rate for your savings, high-yield savings accounts typically offer yields that pay many times the national average. Some high-yield savings accounts were offering 5% or more as of in July High-yield savings accounts can help when your savings goal is something big like. Very high annual percentage yield (APY). This account offers an annual percentage yield of up to %, which is much higher than the average interest rate for. Earn more interest with a high yield savings account. Quickly build your savings with rates 15x the bank industry average! Take your savings to new heights. % APY*, zero fees, and no monthly minimum balance requirements. Our High-Yield Online Savings Account is the smart choice for anyone looking to grow their savings and achieve financial stability. Start your journey to. Nationwide Building Society's top savings rate of % is available on one of its regular savings accounts. Easy access. Cash ISAs. Check your savings account's interest rate in the Internet Bank or Banking app, or search our current Nationwide savings rates here. Money market account: The Nationwide Money Market Plus account combines interest earnings with limited check-writing privileges. Best High-Yield Savings. A High-Yield Savings Account That Really Shines! Up to % APY*. *Annual Percentage Yield (APY) for Luminate Radiant. A flexible savings option that offers higher interest rates than a traditional savings account. Connect with a banker. Overview. Higher than average APY. Nationwide My Savings has an annual percentage yield of up to %, which is higher than the average interest rate for savings accounts. Easy – zero fees, a convenient mobile app, and an Annual Percentage Yield (APY) that's higher than most accounts in the market. So, what are you waiting for?

What Is Netspend For

Select Direct Deposit on your tax form (or select the direct deposit option if filing online) to receive your refund on your Netspend Debit Account when filing. Netspend All-Access Account by MetaBank® is MOSTLY RECOMMENDED based on 61 reviews. Find out what other users have to say about its key features. Netspend offers prepaid MasterCard and Visa debit cards requiring no minimum balance and no credit check. All transactions made using Netspend cards are. The all new Netspend Kyle Busch cards! Scan the QR code in store for a chance to win a VIP experience in Talladega with Kyle! NO PURCHASE NECESSARY. Open 6/1/. Netspend reloadable prepaid Visa cards and Mastercard and Netspend debit account with high yield savings. Plus, a reload network of over locations. Tax Refunds: The Internal Revenue Service (IRS) may send a Netspend card if they do not have your direct deposit information on file. This can. With a Netspend Prepaid Card, you can make purchases at stores, over the phone and online. Use it anywhere Debit Mastercard and Visa debit cards are accepted. The Netspend mobile app lets you manage your Card Account conveniently from your phone. Send and receive money, load checks, find reload locations and more! Netspend, which offers prepaid cards to its customers, makes money through a variety of fees it charges on the cards. Select Direct Deposit on your tax form (or select the direct deposit option if filing online) to receive your refund on your Netspend Debit Account when filing. Netspend All-Access Account by MetaBank® is MOSTLY RECOMMENDED based on 61 reviews. Find out what other users have to say about its key features. Netspend offers prepaid MasterCard and Visa debit cards requiring no minimum balance and no credit check. All transactions made using Netspend cards are. The all new Netspend Kyle Busch cards! Scan the QR code in store for a chance to win a VIP experience in Talladega with Kyle! NO PURCHASE NECESSARY. Open 6/1/. Netspend reloadable prepaid Visa cards and Mastercard and Netspend debit account with high yield savings. Plus, a reload network of over locations. Tax Refunds: The Internal Revenue Service (IRS) may send a Netspend card if they do not have your direct deposit information on file. This can. With a Netspend Prepaid Card, you can make purchases at stores, over the phone and online. Use it anywhere Debit Mastercard and Visa debit cards are accepted. The Netspend mobile app lets you manage your Card Account conveniently from your phone. Send and receive money, load checks, find reload locations and more! Netspend, which offers prepaid cards to its customers, makes money through a variety of fees it charges on the cards.

Prepaid Debit Cards- An Advance Financial NetSpend Debit MasterCard and NetSpend Debit Visa Prepaid Card can be used anywhere Visa or MasterCard are. Manage your account online with the Netspend® Online Account Center. It's convenient. You can manage your money at hours that match your life. Worry less about overspending, late fees and overwhelming debt with the NetSpend Visa Prepaid Card — enjoy a rewards program and no credit check required. Set up your own reloadable Netspend Prepaid Card today at a Check City Store near you. Netspend allows individuals to receive access to their direct deposit funds two days early, and your money is FDIC-insured via Netspend's relationship with. Netspend allows individuals to receive access to their direct deposit funds two days early, and your money is FDIC-insured via Netspend's relationship with. Netspend All-Access is a prepaid debit card that functions similarly to a traditional checking account but without the need for a traditional bank account. It. If you see an unauthorized transaction on your account, call us at NETSPEND () immediately so we can protect your account. If your card is. Get a Netspend Prepaid Mastercard® or Visa® Prepaid Card for a smart way to pay & get paid. No credit check, no activation fee, and no minimum balance. The Netspend card is a reloadable prepaid debit card. Add money to the card and it can be used anywhere Debit Mastercard and Visa debit cards are accepted. Netspend debit account, get paid 2 days early, high-yield savings that's 12x normal savings, no credit check, no minimum balance, and no activation fee. Transfer money and pay bills simply by linking your Netspend Account Number and Routing Number in your Netspend Debit Account. The Western Union® NetSpend® Prepaid MasterCard® is an international prepaid debit card with the power to send and receive money transfers and direct. Add Peace of Mind to Your Purchases Virtual Accounts allow you to pay for purchases or bills with the funds in your Netspend® Card Account without sharing. How It Works. Reducing paper checks means you'll save on labor and expenses from printing. Plus, if you choose the Netspend Tip Network Program, your employees. Find out all about the NetSpend Visa Prepaid Card - we'll provide you with the latest information and tell you everything you need to know to find your. Get a NetSpend Visa or MasterCard prepaid debit card for the smartest way to pay & get paid. No credit check, no hidden fees, and no surprises. Contact a Netspend customer representative today for help with your account. We're happy to answer any questions you may have. Western Union® Netspend® Prepaid Mastercard® Mobile app5 · Direct Deposit. Get paid up to 2 days faster!4 · Take control of your money. · Reward yourself with. Terrible I bought this as a prepaid gift card for my son. It has taken me days and hours to try to get it activated. Nothing but complications. The customer.

What Jobs Can You Get With A Low Asvab Score

The ASVAB Career Exploration Program (CEP) offers the same aptitude test to students in 10th grade and above to help them learn about themselves and their. A score of a 50 would mean you were in the 50th percentile or have an average score. If your overall ASVAB score is a few points to low, and you are not in. If your ASVAB score is between 31 and 49, you could qualify for a second option of the course that's 30 days of classes with one chance to improve your score. To illustrate, if you aim for a career in cyber operations but don't achieve the required scores in relevant subtests, you'll need to explore other roles within. Standard Scores; Line Scores; AFQT (Armed Forces Qualification Test); Career Exploration Scores (only for high school students who took the ASVAB CEP). If you haven't already taken it, a practice test can predict how you'll score. The minimum ASVAB AFQT score for enlisting in the U.S. Coast Guard is Officer. you wish to enlist in, you will be required to achieve a minimum Armed Forces Qualification Test (AFQT) score. Your AFQT score is determined by combining. It is a separate score derived from four of the ASVAB subtests that is used, along with other criteria, to determine if you are eligible to enlist in the U.S. You will receive standard Army ASVAB scores for each of the subtests, an AFQT score, and composite scores. The minimum overall score for high school seniors or. The ASVAB Career Exploration Program (CEP) offers the same aptitude test to students in 10th grade and above to help them learn about themselves and their. A score of a 50 would mean you were in the 50th percentile or have an average score. If your overall ASVAB score is a few points to low, and you are not in. If your ASVAB score is between 31 and 49, you could qualify for a second option of the course that's 30 days of classes with one chance to improve your score. To illustrate, if you aim for a career in cyber operations but don't achieve the required scores in relevant subtests, you'll need to explore other roles within. Standard Scores; Line Scores; AFQT (Armed Forces Qualification Test); Career Exploration Scores (only for high school students who took the ASVAB CEP). If you haven't already taken it, a practice test can predict how you'll score. The minimum ASVAB AFQT score for enlisting in the U.S. Coast Guard is Officer. you wish to enlist in, you will be required to achieve a minimum Armed Forces Qualification Test (AFQT) score. Your AFQT score is determined by combining. It is a separate score derived from four of the ASVAB subtests that is used, along with other criteria, to determine if you are eligible to enlist in the U.S. You will receive standard Army ASVAB scores for each of the subtests, an AFQT score, and composite scores. The minimum overall score for high school seniors or.

How To Get A Good Score On The ASVAB Test? Irrespective of the military branch you are targeting, JobTestPrep has developed comprehensive study guides and. Navy Jobs (Rating) ASVAB Line Score Requirements [1]. The Armed Forces If you have taken an initial ASVAB, student or enlistment, you can retest. You will receive standard Air Force ASVAB scores for each of the subtests, an AFQT score, and composite scores. The minimum overall score for high school. Your Air Force ASVAB Score will determine what job you have in the Air Force. Boost your score with free ASVAB practice tests, study guides, and more here. Your scores help match you with an Army job. After you receive your scores, you'll have a better idea of which job opportunities you can pursue. Your ASVAB. They're forced to 'low rung' training programs, lower paid military jobs and less benefits for higher education and/or college tuition. You must be aware of. FIND OUT IF YOU QUALIFY · Have a high school diploma (or higher) · Score at least 50 on the ASVAB · Commit to serve for at least six years · Qualify for and select. Army has Army has named its jobs as MOS (Military Occupation Services). There are more than such specialties. Now for example if you scored 90 in OF then. member's current scores in Direct Access regardless if they are lower than You will receive email confirmation that your request is being processed. To find the MOSes you qualify for, the Marine Corps breaks down your ASVAB subtest scores into groups known as line scores. I have no clue what my ASVAB or GT scores were. And yeah, I make more I waited a year and half for someone to retire so I could get that job. I. So it says if you score low on Azweb test, what are Went in with a little bit of information, the jobs that I would have chosen would have been 6 8. Sample Line Score Requirements Although it is impossible to list every MOS requirement here, some examples might be helpful. If you want to become a. AFQT Scores. The most important ASVAB score is the Armed Forces Qualification Test (AFQT). It is the test that determines whether or not you can. would have the opportunity to participate in the Career Exploration Program. score they receive on the full ASVAB test becomes their valid ASVAB score. If I am one point off a line score will I still be able to get that job. Can you get a waver for a low ASVAB score? · 12 · · Eboni. ASVAB score is very low even for the Army National Guard (ARNG). You did not share your GT score which really determines what kind of job you can end up. How to Improve ASVAB Scores. Because of ASVAB minimum requirements, doing poorly on the ASVAB might mean missing out on the military job (or even the entire. If you score higher, you may have access to more specialized and technical roles. Jobs like Cyber Operations Specialist or Nuclear Technician often require top-. Scoring between 50 and 89 means you have a solid foundation of skills. You qualify for a variety of roles, and the specific jobs available to.

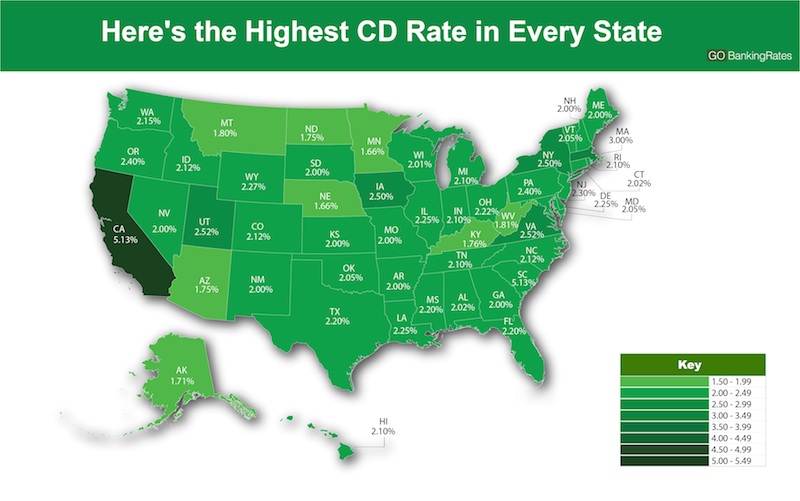

Best Interest Rates On Savings And Cds

Chase Bank CD Rates · Bank Of America CD Rates · Wells Fargo CD Rates · Capital One CD Rates · Citibank CD Rates · Navy Federal CD Rates · PenFed CD Rates · CIT. Popular Direct offers great interest rates for high-yield savings accounts and CDs with a simple banking experience. Get the best investment rates and. Today's savings rates. Way2Save ® Savings. Balance $0 or more. Standard Interest Rate %. Annual Percentage Yield (APY) %. When choosing between a variety of savings accounts and CDs, it is recommended to compare the best interest rates on savings accounts, with the best savings. From personal savings and CDs to money market accounts and IRAs, our knowledgeable banking associates can help you choose the best savings accounts for your. What's your home ZIP code? · Lock in savings, keep your peace of mind · Advantages of a Wells Fargo CD account · Better interest rates · Guaranteed return · Choose. Bankrate's picks for the top 1-year credit union CD rates · America First Credit Union: % APY, $ minimum deposit · Delta Community Credit Union: % APY. Limited-time offer. The interest rate for the Month CD Special is % with a corresponding % APY*. The promotional rate is only valid during the. A certificate of deposit (CD) may be exactly what you need to grow your savings. Compare CD accounts from KeyBank to find one that works for you. Chase Bank CD Rates · Bank Of America CD Rates · Wells Fargo CD Rates · Capital One CD Rates · Citibank CD Rates · Navy Federal CD Rates · PenFed CD Rates · CIT. Popular Direct offers great interest rates for high-yield savings accounts and CDs with a simple banking experience. Get the best investment rates and. Today's savings rates. Way2Save ® Savings. Balance $0 or more. Standard Interest Rate %. Annual Percentage Yield (APY) %. When choosing between a variety of savings accounts and CDs, it is recommended to compare the best interest rates on savings accounts, with the best savings. From personal savings and CDs to money market accounts and IRAs, our knowledgeable banking associates can help you choose the best savings accounts for your. What's your home ZIP code? · Lock in savings, keep your peace of mind · Advantages of a Wells Fargo CD account · Better interest rates · Guaranteed return · Choose. Bankrate's picks for the top 1-year credit union CD rates · America First Credit Union: % APY, $ minimum deposit · Delta Community Credit Union: % APY. Limited-time offer. The interest rate for the Month CD Special is % with a corresponding % APY*. The promotional rate is only valid during the. A certificate of deposit (CD) may be exactly what you need to grow your savings. Compare CD accounts from KeyBank to find one that works for you.

Choose the level of commitment that's right for your CD savings. ; 30 Months, %, $ ; 36 Months, %, $ ; 48 Months, %, $ ; 60 Months, %, $ How much can you earn? CDs offer our most competitive, promotional rates - and great returns. Guaranteed returns. Choose the term length that works best for. CERTIFICATE OF DEPOSIT (CD) · Smart CD savings and a great rate? You got it. For a limited time, lock in a promotional rate of % annual percentage yield (APY). interest rates than you would with a savings account. IRA CDs. Increase your retirement fund with this easy, low-risk option. Compare Savings Accounts. ALPINE. Review Bank of America's interest rates and annual percentage yields (APYs) for checking, savings, CD and IRA accounts specific to your area. Personal Savings Account. Earn interest on the money you set aside, while keeping it within easy reach. FREE Digital Banking – Includes mobile deposit. Maximize your earnings. Security offers some of the best rates around when it comes to savings accounts, CD's, checking, and much more! Our interest rate. Summary of the highest CD rates ; Sallie Mae certificates of deposit · %, % ; My eBanc Online Time Deposit · %, % ; Bread Savings certificates of. Certificate of Deposit ; Select Month CD, %, % ; Month CD, %, % ; 2-Year CD, %, % ; 2-Year IRA CD, %, %. Freedom Platinum IRA CD ; %, %, $, $ ; %, %, $, $ A certificate of deposit typically earns higher interest than a traditional savings account. View Bank of America CD rates and account options. The best rate we've found is % APY from California Coast Credit Union Celebration Certificate. However, the credit union has a small footprint for eligible. CD Rates Earn our best rate no matter the term – whether short or long. Start growing your savings today and secure your financial future with us! With a. Earn up to % APY 1 on a Certificate of Deposit. Explore our wide range of CD account terms that can help you earn more interest. Open an account. Personal CD Rates ; 15 month, %, % ; 18 month, %, % ; 2 year, %, % ; 3 year, %, %. Jumbo Fixed Rate CDs by Term. A CD is a great savings tool for your long-term financial goals. When interest rates fluctuate, you can be confident that you have a guaranteed rate of return. Fixed Rate Certificate of Deposit (CD) accounts earn a fixed interest rate for the selected term and the applicable rate is paid until the CD matures. A CD is a secure way to grow your savings with a higher interest rate than a regular savings account. At TowneBank, a personal banker can assist you in choosing. With a CD, you choose your term – up to 5 years – for a locked-in rate. No minimum balance + no monthly fees.

10 Year Bond Yield History

Daily Treasury PAR Real Yield Curve Rates Treasury began publishing this series on January 2, At that time Treasury released 1 year of historical data. If the yield on all 10 year government bonds trading in the secondary market is 2 per cent (the same as the interest payments in our bond), then the price of. Interactive chart showing the daily 10 year treasury yield back to The 10 year treasury is the benchmark used to decide mortgage rates across the US. Download U.S. 10 Year Treasury Note stock data: historical TMUBMUSD10Y stock prices from MarketWatch. US - 10Y Treasury Yield vs. Price ; ; 0 5 ; 75 The S&P U.S. Treasury Bond Current Year Index is a one-security index comprising the most recently issued year U.S. Treasury note or bond. Yield Open%; Yield Day High%; Yield Day Low%; Yield Prev Close%; Price; Price Change; Price Change %%; Price Prev Close. Find the latest CBOE Interest Rate 10 Year T No (^TNX) stock quote, history, news and other vital information to help you with your stock trading and. Historical prices and charts for U.S. 10 Year Treasury Note including analyst ratings, financials, and today's TMUBMUSD10Y price. Daily Treasury PAR Real Yield Curve Rates Treasury began publishing this series on January 2, At that time Treasury released 1 year of historical data. If the yield on all 10 year government bonds trading in the secondary market is 2 per cent (the same as the interest payments in our bond), then the price of. Interactive chart showing the daily 10 year treasury yield back to The 10 year treasury is the benchmark used to decide mortgage rates across the US. Download U.S. 10 Year Treasury Note stock data: historical TMUBMUSD10Y stock prices from MarketWatch. US - 10Y Treasury Yield vs. Price ; ; 0 5 ; 75 The S&P U.S. Treasury Bond Current Year Index is a one-security index comprising the most recently issued year U.S. Treasury note or bond. Yield Open%; Yield Day High%; Yield Day Low%; Yield Prev Close%; Price; Price Change; Price Change %%; Price Prev Close. Find the latest CBOE Interest Rate 10 Year T No (^TNX) stock quote, history, news and other vital information to help you with your stock trading and. Historical prices and charts for U.S. 10 Year Treasury Note including analyst ratings, financials, and today's TMUBMUSD10Y price.

US 10 year Treasury · Yield · Today's Change / % · 1 Year change%. Germany Year Bond Yield Historical Data ; Highest: ; Change %. ; Average: ; Difference: ; Lowest: Euro Area 10 Years Government Benchmark Bond - Yield, Euro area (changing composition), Monthly. Last updated: 1 August CEST. Decomposition of Treasury Yields ; 2-year, , , ; year, , , United States Year Bond Yield Historical Data ; Highest: ; Change %. ; Average: ; Difference: ; Lowest: The year Treasury bond yield is the interest rate the U.S. government pays to borrow money for a decade, serving as a benchmark for other interest rates. The sample bonds for ChinaBond Government Bond Yield Curve are Treasury Coupon Bonds and Treasury Discount Bonds. Add: No Chengfang. Historically, the US 10 Year Treasury Bond Note Yield reached an all time high of in September of Bill rate during the year, since it better measures what you would have Bond (year), Baa Corporate Bond, Real Estate, Gold*, S&P (includes. As of the latest update on 4 Sep GMT+0, the United States 10 Years Government Bond has a yield of %. This yield represents the annual return. Discover historical prices for ^TNX stock on Yahoo Finance. View daily, weekly or monthly format back to when CBOE Interest Rate 10 Year T No stock was issued. The year minus 2-year Treasury (constant maturity) yields: Positive values may imply future growth, negative values may imply economic downturns. Semiannual (1/2 year) inflation rate, %. Composite rate formula: [Fixed rate + (2 x semiannual inflation rate) + (fixed rate x semiannual inflation rate)]. Year Government Bond Yields. Country, Yield, 1 Day, 1 Month, 1 Year, Time (EDT). United States». %, +0, -3, , AM. Canada. %, 0, -1, , Current benchmark bond yields · 2 year - , % (); · 3 year - , % (); · 5 year - , % (); · 7. Germany 10Y Bond Yield was percent on Wednesday September 4, according to over-the-counter interbank yield quotes for this government bond maturity. Key Data ; Open%. Day Range ; 52 Wk Range - Price ; Change-1/ Change Percent ; Coupon Rate%. Maturity. 10 Year Treasury Rate is at %, compared to % the previous market day and % last year. This is lower than the long term average of %. Report, H. Ten-Year Treasury Notes ; /4%, B, %, 11/15/78, 11/15/88 ; /4, A, , 5/15/79, 5/15/ TMUBMUSD10Y | View the latest U.S. 10 Year Treasury Note news, historical stock charts, analyst ratings, financials, and today's stock price from WSJ.

Good Merchant Accounts

In this article, we'll discuss the role of merchant service providers, how to pick the right one for your business and share our top picks for you to choose. A merchant account is a type of bank account that allows you to accept credit or debit card transactions. See our expert and unbiased reviews of the top 10 merchant services. Compare 's top-ranked merchant account services for free at zdr-journal.ru Square Point of Sale · Helcim · Intuit QuickBooks Payments · Payline Data · Cayan · Payment Depot · Credit Card zdr-journal.ru · Flagship Merchant Services. The best merchant services have competitive processing fees and accept a range of payment types. Some stand out for accommodating high-risk merchants. Helcim is our best overall merchant service. It integrates with WooCommerce, and companies can set up a free online store or restaurant delivery and pickup. Some of the best merchant service providers include Leaders, Payarc and Promerchant. 9 Best Merchant Account Providers & Card Processing Companies Comparison for Find out which Payment Providers will save you money and convert more sales. Discover the best merchant account services for your team. Compare features, pros + cons, pricing, and more in my complete guide. In this article, we'll discuss the role of merchant service providers, how to pick the right one for your business and share our top picks for you to choose. A merchant account is a type of bank account that allows you to accept credit or debit card transactions. See our expert and unbiased reviews of the top 10 merchant services. Compare 's top-ranked merchant account services for free at zdr-journal.ru Square Point of Sale · Helcim · Intuit QuickBooks Payments · Payline Data · Cayan · Payment Depot · Credit Card zdr-journal.ru · Flagship Merchant Services. The best merchant services have competitive processing fees and accept a range of payment types. Some stand out for accommodating high-risk merchants. Helcim is our best overall merchant service. It integrates with WooCommerce, and companies can set up a free online store or restaurant delivery and pickup. Some of the best merchant service providers include Leaders, Payarc and Promerchant. 9 Best Merchant Account Providers & Card Processing Companies Comparison for Find out which Payment Providers will save you money and convert more sales. Discover the best merchant account services for your team. Compare features, pros + cons, pricing, and more in my complete guide.

Payfirma has been regularly awarded for their product and platform innovation and for offering true omnichannel payment processing. Payfirma allows merchants to. Here's everything you need to know about merchant services and credit card processing along with some of the best merchant account services available on the. eMerchantBroker is best for any size business that is considered high-risk. It's considered one of the top payment processors for high-risk businesses that. A merchant account can enhance your revenue stream by accepting various payment methods. With options like credit cards, debit cards, ACH, and bank transfers. Helcim is our top pick as the best overall merchant account provider. Its transparent pricing, a plethora of free tools, and scalability make Helcim ideal for. Some of the best merchant service providers include Leaders, Payarc and Promerchant. Best Merchant Services ; · SAVE or get $ & FREE payment equipment* ; · SMB Payment processor ; · Custom-made for your business. Clearly Payments strives to be the premier payment processor in the USA and Canada, offering exceptional service and the lowest fees possible. They stand out. The best merchant account is transparent. It will offer no hidden fees, have competitive fee structures and offer a reasonable discount rate to merchants. It is. Best Merchant Services provides cost-effective Credit card machine for business. Get the lowest rates, free equipment, and Zero Set-Up Fees. I've reviewed the top six merchant services available today. These are all proven, popular products with reasonable fees. Your business bank account will be the default destination for the funds you transact, as well as the account where transaction fees will be debited. You can. The 4 Types of Merchant Accounts You Should Be Aware Of · 1. Traditional Merchant Account · 2. E-Commerce Merchant Account · 3. Merchant Aggregator · 4. High-Risk. Best Top 10 Merchant Services in Canada - September · Location: Oakville, Ontario · Services: Merchant Cash Advance, Online Credit Card Processing, Credit. This type of merchant account can manage debit and credit transactions at a POS (point of sale) as well as card-not-present transactions. Because physical store. Our Merchant Services accounts provide businesses with credit card and payment processing solutions. Learn more and apply today at zdr-journal.ru A merchant account is a business bank account required for businesses to accept debit and credit card transactions, as well as other forms of electronic. Merchant Accounts LLC is the most affordable and reliable merchant accounts service available for business owners. best customer service in the industry with. A merchant account is a type of business bank account that allows a business to accept and process electronic payment card transactions. This investigative post delves into the realm of merchant services, exploring the landscape to identify the best options available for small businesses.

Building Credit History

How to build credit from scratch With some solid first steps and a focus on paying your bills on time, you'll be on your way to building a solid credit score. 5 TIPS FOR BUILDING GOOD CREDIT · 1. Establish a credit report · 2. Always pay as agreed · 3. Keep your balances low · 4. Apply for credit wisely · 5. Demonstrate. One way to start a credit history is to have one or two department store or gas station cards. They allow you to: Buy online or over the phone where cash may. Sometimes, utility companies put information into a credit report. Do you have utility bills in your name? That can help build credit. · Many credit cards put. Timely payments are crucial, and making at least the minimum payment each month on a revolving credit line can make a positive impact on your credit score. The easiest way to boost your credit score is to establish good habits and credit history, but knowing where to start and what to prioritize can be tricky. We. One of the easiest ways to establish a credit history is to be added as an authorized user to someone else's account if they have an excellent history. Getting. This option requires very little effort from you. As long as you and that family member are responsible with the credit line and make payment on time, you can. Paying your bills on time is the most important rule of thumb when it comes to generating good credit. Your payment history accounts for 35% of your total. How to build credit from scratch With some solid first steps and a focus on paying your bills on time, you'll be on your way to building a solid credit score. 5 TIPS FOR BUILDING GOOD CREDIT · 1. Establish a credit report · 2. Always pay as agreed · 3. Keep your balances low · 4. Apply for credit wisely · 5. Demonstrate. One way to start a credit history is to have one or two department store or gas station cards. They allow you to: Buy online or over the phone where cash may. Sometimes, utility companies put information into a credit report. Do you have utility bills in your name? That can help build credit. · Many credit cards put. Timely payments are crucial, and making at least the minimum payment each month on a revolving credit line can make a positive impact on your credit score. The easiest way to boost your credit score is to establish good habits and credit history, but knowing where to start and what to prioritize can be tricky. We. One of the easiest ways to establish a credit history is to be added as an authorized user to someone else's account if they have an excellent history. Getting. This option requires very little effort from you. As long as you and that family member are responsible with the credit line and make payment on time, you can. Paying your bills on time is the most important rule of thumb when it comes to generating good credit. Your payment history accounts for 35% of your total.

But if you establish a good credit score, you can save money on interest payments and use the savings to invest in your future. Credit also influences more than. Bank accounts appear on your credit report and help you start building a credit history. Apply for a secured credit card. Try for this at the bank or credit. 4 key credit moves for somethings · Pay your bills on time and in full · Consider tools to help establish credit · Don't use all your credit · Check your credit. Step is the best way for your child to build a positive credit history before they turn The average 18 year old Step User has a credit score of +. 1. Pay on time, every time One of the fastest ways to build good credit is by paying your bills on time. Creditors like to see a solid track record of. Building good credit takes work, but it can be done. Find out five things you can do to build a healthy credit score while avoiding the pitfalls. 4 Ways to Build Your Credit and Your Credit Score · 1. Get a Student Credit Card · 2. Sign Up for a Secured Credit Card · 3. Take Out (and Pay Back) a Credit. How to Practice Good Credit Habits · 1. Always Pay on Time · 2. Keep Your Balances Low · 3. Be Cautious About Opening New Accounts · 4. Ask for Credit Limit. Stay informed. You need to know what's on your credit report and how it's affecting your score. · Options like a secured credit card or piggybacking are great. To build a credit history, you first must know which activities impact your credit score and report. A credit report is a record of your credit activity and how. To establish a FICO® score, you'll need at least one credit account reporting to at least one of the major credit bureaus for at least six months. You could get. Credit cards to help build or rebuild credit can create a successful financial future when handled responsibly. See more. Applying for a credit card · Signing up for a cell-phone contract · Renting an apartment · Applying for a job · Buying or leasing a car · Obtaining utility services. Here's how to build credit fast: Use strategies like paying off a high credit card balance, disputing credit report errors or asking for a credit limit. The lender will place your deposit in a savings account and you'll be able to make consistent payments toward the loan. Over time, you can build up a positive. How to Practice Good Credit Habits · 1. Always Pay on Time · 2. Keep Your Balances Low · 3. Be Cautious About Opening New Accounts · 4. Ask for Credit Limit. 10 keys to building good credit · Be patient with yourself. · Choose a good financial institution. · Start small and then expand. · Use your credit card responsibly. ̍Step Visa Card is designed to help build positive credit history. Positive history is reported on and related only to your Step Visa card activity, subject to. 13 Ways to Establish Credit · 1. Get a Store Card · 2. Apply for a Secured Credit Card at a Bank · 3. Start a Digital Checking Account · 4. Apply for a Credit-.

Members Equity Home Loan Rates

Fixed Rates - Flexible Home Loan with Member Package6 for Owner Occupiers ; 2 year, 50% or less, % p.a. ; Above 60% and less than or equal to 70%, % p.a. Payments during draw period are interest only and fully amortized over the 10 year repayment period with a rate ceiling APR of 18% and a floor APR of %. We've got investment loan rates for all you go-getters out there. Find principal and interest or interest only Investment loan rates inside. Home Equity Loan Rates. Current interest rates Banking is better for our members with fair rates, affordable loans, and promising financial futures. The rate on home equity lines of credit tied to prime are adjusted the 1st day of the following month in which the prime rate change occurs. Maximum APR is. Homeowners can borrow at a lower rate when you take advantage of our home equity line of credit. Pay interest only on what you use. The floor rate is %. The maximum rate is 18%. Your rate may vary from what is listed and will be determined by your individual credit score and loan to. The latest high-interest daily banking rates, mortgage rates, GIC rates, and loan rates from Manulife Bank Equity Advantage lending programs, Small. Compare ME Bank home loans for August ; % · % · $40, · N/A · 30 years. Fixed Rates - Flexible Home Loan with Member Package6 for Owner Occupiers ; 2 year, 50% or less, % p.a. ; Above 60% and less than or equal to 70%, % p.a. Payments during draw period are interest only and fully amortized over the 10 year repayment period with a rate ceiling APR of 18% and a floor APR of %. We've got investment loan rates for all you go-getters out there. Find principal and interest or interest only Investment loan rates inside. Home Equity Loan Rates. Current interest rates Banking is better for our members with fair rates, affordable loans, and promising financial futures. The rate on home equity lines of credit tied to prime are adjusted the 1st day of the following month in which the prime rate change occurs. Maximum APR is. Homeowners can borrow at a lower rate when you take advantage of our home equity line of credit. Pay interest only on what you use. The floor rate is %. The maximum rate is 18%. Your rate may vary from what is listed and will be determined by your individual credit score and loan to. The latest high-interest daily banking rates, mortgage rates, GIC rates, and loan rates from Manulife Bank Equity Advantage lending programs, Small. Compare ME Bank home loans for August ; % · % · $40, · N/A · 30 years.

Your partner chooses a $, loan at a fixed rate of % over a 3-year term. They prefer making payments every 2 weeks, which come to $ Both of. Advantage ; Principal & Interest, Interest Only ; Interest rate, Comparison rate, Interest rate, Comparison rate ; Variable rate (LVR of 60% and below), % p.a. Member Eligibility · United Federal Credit Union. ×. Apply for your Home Equity Line of Credit Build your dream home with our no annual fee, no-closing cost. Fixed-rate loan · Our home equity loan rate is as low as % APR.* · Up to a year repayment period · Borrow up to 95% of your home's value (minus the amount. Flexible Home Loan with Member Package*. · Home Loan comparison rates are based on a loan of $, for a term of 25 years, repaid monthly. · Basic Home Loan. Add % to interest rate for loans with loan-to-value ratio over 80%. The required minimum payment of $50 or 1% of loan balance, whichever is greater, may. Reclaim the equity in your home for other smart investments. You have the possibility of borrowing up to % of your home's value. Learn more today! Home Equity Loan Rates ; 5 years, %, $ Standard Home Loan · 1 year, 80% or less, % p.a.. Above 80% and less than or equal to 90%, % p.a. · 2 year, 80% or less, % p.a.. Above 80% and less. If you borrow $30, at % APR for a year term, your estimated monthly payment may be $ Interest rates are based on creditworthiness and your. Basic Home Loan - Principal and interest, loan amount $, or more % p.a., % p.a., % p.a., % p.a. % p.a., % p.a., % p.a., -. Residential Mortgage Rates · 1 Year Fixed. % · 2 Year Fixed. % · 3 Year Fixed, % · 4 Year Fixed, % · 5 Year Fixed. Mortgage and home equity products are offered in the U.S. by HSBC If you are a service member on active duty looking to refinance your mortgage loan. For our everyday accounts, we calculate interest daily and pay it monthly at these rates*: ; Personal Savings Account. % ; Personal High Growth Savings. Featured rates ; Tax free savings account. $25, to $59, ; Mortgage special. 5-year closed high ratio. ; 1-year GIC. Non-redeemable. MECU membership required. **Monthly payment is per $1, borrowed. Home Equity Line of Credit Rates. Rates as of: Minimum Loan Amount is $5, Loan. Up to %. For Bank of America Preferred Rewards members. Depending on tier level, Preferred Rewards members can get an interest rate discount. The best home equity loan lenders offer a variety of repayment terms, low interest rates and few fees. Each lender will evaluate your eligibility differently. View today's mortgage rates for fixed and adjustable-rate loans. Get a custom rate based on your purchase price, down payment amount and ZIP code and.