zdr-journal.ru

Learn

Rent On Balance Sheet

To recap the above, the monthly rent payment keeps the sole proprietor's accounting equation, Assets = Liabilities + Owner's Equity, in balance because it. Balance Sheet is a snapshot of the financial position of Rent the Runway at a specified time, usually calculated after every quarter, six months, or one year. Rent expense is the cost incurred by a business to utilize a property as an office, factory, storage, retail space, or general use space. The periodic lease expense for an operating lease under ASC is the product of the total cash payments due for a lease contract divided by the total number. All leases will be required to be capitalized on the balance sheet except short term leases (12 months or less). The lease is recognized as both an asset and. In the context of a business's financial statements, rent expense is usually reported on the income statement as an operating expense. When a business leases a. Rent expense refers to the total cost of using rental property for each reporting period. It is typically among the largest expenses that companies report. The new standard on leases, IFRS 16, affects the accounting for leases and rental agreements that are currently only recognised as an operating expense in. Deferred rent occurs when a lease payment is less than its recognized expense. Under ASC , the deferred-rent classification has become obsolete. To recap the above, the monthly rent payment keeps the sole proprietor's accounting equation, Assets = Liabilities + Owner's Equity, in balance because it. Balance Sheet is a snapshot of the financial position of Rent the Runway at a specified time, usually calculated after every quarter, six months, or one year. Rent expense is the cost incurred by a business to utilize a property as an office, factory, storage, retail space, or general use space. The periodic lease expense for an operating lease under ASC is the product of the total cash payments due for a lease contract divided by the total number. All leases will be required to be capitalized on the balance sheet except short term leases (12 months or less). The lease is recognized as both an asset and. In the context of a business's financial statements, rent expense is usually reported on the income statement as an operating expense. When a business leases a. Rent expense refers to the total cost of using rental property for each reporting period. It is typically among the largest expenses that companies report. The new standard on leases, IFRS 16, affects the accounting for leases and rental agreements that are currently only recognised as an operating expense in. Deferred rent occurs when a lease payment is less than its recognized expense. Under ASC , the deferred-rent classification has become obsolete.

By December 20X4 the deferred rents balance will decrease to $ So, over the 12 months after the balance sheet date $20 (i.e., $ - $) of deferred rent. A real estate balance sheet reports how much a property is really worth by subtracting liabilities from asset value. IFRS 16 replaces the straight-line operating lease expense with a depreciation charge for the lease asset (included within operating costs) and an interest. Prepaid rent expense, which refers to advance payments for future occupancy rights, usually recorded as an asset on the balance sheet and gradually expensed. Rent Payable is a liability account in the general ledger of the tenant which reports the amount of rent owed as the date of the balance sheet. Example of Rent. Use this free excel template to generate a balance sheet for your investment property. This balance sheet template simplifies the balance sheet process. Rent the Runway Inc. annual balance sheet for RENT company financials. Deferred rent occurs in lease accounting when the cash rent payments are different than its recognized financial statements. Answer to: How do you record a rent payment on a balance sheet in accounting? By signing up, you'll get thousands of step-by-step solutions to your. Rent payable is part of the "short-term debts" section of a balance sheet, also known as a statement of financial position or report on financial condition. Answer and Explanation: 1. The answer is Yes, recognition of rent expense during an accounting cycle will affect the balance sheet. Although rent expense will. Typically Rent is an expense and appears on the Income Statement. UNLESS If rent is paid in advance an asset called Prepaid Rent appears on the Balance Sheet. Your balance sheet includes all asset, liability, and equity accounts from your chart of accounts (see: the chart of accounts for rental property). Asset. From a lease accounting perspective, a capital lease is treated as if the lessee has purchased the asset using debt financing. The asset and the associated. On the balance sheet, prepaid rent is listed under current assets. When the rent payment is made, it is initially recorded as an asset because it represents a. Businesses must account for operating leases as assets and liabilities for assets leased for more than 12 months. This standard makes their balance sheet a more. Get the annual and quarterly balance sheet of Rent the Runway, Inc. (RENT) including details of assets, liabilities and shareholders' equity. Rent the Runway Inc. annual balance sheet for RENT company financials. From an accounting perspective, prepaid rent is classified as an asset because it represents the prepayment of an expense that will be incurred in the future. In most leases, deferred rent is a liability that is recorded as a negative balance. The journal entry for recording during the transition is a debit—or a.

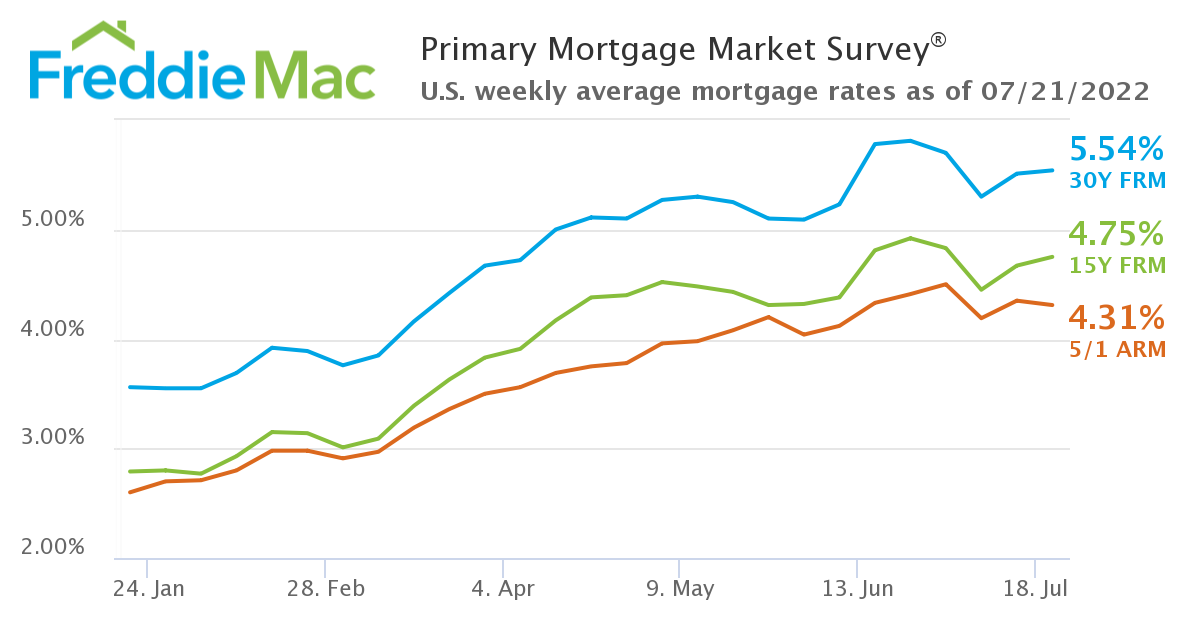

Mortgage Rates Cash Out Refinance

Our home loan refinance options could help reduce your interest rate, shorten your term, or trade in the equity of your home to get cash back at closing. A Cash-Out Refinance† is a mortgage refinance that allows you to access equity in your home. By refinancing and using the equity already in your home to. A cash-out refinance comes with closing costs comparable to your first mortgage. Typically, you can expect to pay between 2% and 5% of the loan amount. So on a. Cash-out Refinance · % · %. The Cash-Out Refinance Loans enables homeowners to trade equity for cash from their home. Eligibility Requirements · Ownership of the Property · Ineligible Transactions · Acceptable Uses · Delayed Financing Exception · Student Loan Cash-Out Refinances. A cash-out refinance typically has a lower interest rate than a home equity loan or HELOC, and refinancing may provide a lower rate than your current mortgage. A cash-out refinance replaces an existing mortgage with a new loan with a higher balance, sometimes with more favorable terms than the current loan. Weekly national mortgage interest rate trends ; 30 year fixed refinance, % ; 15 year fixed refinance, % ; 10 year fixed refinance, % ; 5/1 ARM refinance. Our home loan refinance options could help reduce your interest rate, shorten your term, or trade in the equity of your home to get cash back at closing. A Cash-Out Refinance† is a mortgage refinance that allows you to access equity in your home. By refinancing and using the equity already in your home to. A cash-out refinance comes with closing costs comparable to your first mortgage. Typically, you can expect to pay between 2% and 5% of the loan amount. So on a. Cash-out Refinance · % · %. The Cash-Out Refinance Loans enables homeowners to trade equity for cash from their home. Eligibility Requirements · Ownership of the Property · Ineligible Transactions · Acceptable Uses · Delayed Financing Exception · Student Loan Cash-Out Refinances. A cash-out refinance typically has a lower interest rate than a home equity loan or HELOC, and refinancing may provide a lower rate than your current mortgage. A cash-out refinance replaces an existing mortgage with a new loan with a higher balance, sometimes with more favorable terms than the current loan. Weekly national mortgage interest rate trends ; 30 year fixed refinance, % ; 15 year fixed refinance, % ; 10 year fixed refinance, % ; 5/1 ARM refinance.

Today's competitive refinance rates ; year fixed · % ; year fixed · % ; 5y/6m ARM · %.

Refinance rates by loan term ; year fixed rate. %. % ; year fixed rate. %. % ; year fixed rate. %. % ; year fixed. Refinance your existing mortgage to lower your monthly payments, pay off your loan sooner, or access cash for a large purchase. Use our home value estimator to. As of today, Rate is now offering up to % max LTV (loan-to-value ratio) options on VA cash-out refinances up to $M. Many lenders and cash-out loans cap. Lower monthly payments, payoff your loan sooner or take cash out? 2. Consider the Costs. Talk to a loan officer about your plans. Ask about rates and fees. Cash-out refinance rates today · yr fixed. Rate. %. APR. %. Points (cost). ($4,). Term. yr fixed. Rate · yr fixed. Rate. %. APR. VA Cash-Out refinancing allows qualified Veterans to refinance their VA or non-VA loan and tap into their home equity. A VA cash out refinance allows you to tap your home's equity to get cash. It takes your existing VA loan and replaces it with a new VA loan for a higher amount. Closing costs for a cash out refinance can average between 2% and 6% of the loan amount according to Forbes. Sometimes you can add these costs to your loan. Cash-Out Refinance—It is refinancing with a new loan amount higher than the remaining owed amount on existing mortgages. The difference goes to the borrower in. A conventional refinance loan will only be for the amount that you owe on your existing mortgage, but a cash out refinance loan will increase the amount of the. Use our cash-out refinance calculator to help you determine how much you can cash out and what your new mortgage payment will be after refinancing. Refinance Your Mortgage and Save · Get a Better Loan. Refinance to a lower rate or pay off your loan faster with a shorter term. · Take Cash Out. Use the equity. Cash-out refinance gives you a lump sum when you close your refinance loan. The loan proceeds are first used to pay off your existing mortgage(s), including. These costs can include appraisal fees, attorney fees, and taxes and are usually % of the loan. Do I have to pay taxes on a Cash-Out Refinance? A Cash-Out. What is a cash-out refinance? A cash-out refinance is when you replace your current mortgage with a larger loan and receive the difference in cash. Two. Using a cash-out refinance to consolidate debt increases your mortgage debt, reduces equity, and extends the term on shorter-term debt and secures such debts. The Annual Percentage Rate is %. No prepayment penalty. Payment shown does not include taxes and insurance. The actual payment amount will be greater. Take cash out. Leverage your home's equity with a cash-out refinance and get money to use however you want. Tips for Using the Cash-Out Calculator · Your home's current market value — an estimate of the amount it would sell for in the current real estate market · Your. Use that extra cash to: · Lower interest rates than a personal loan or credit card · No additional monthly payments · Longer repayment terms · No prepayment.

Current Arm Interest Rates

Compare Today's 5-Year ARM Rates ; APR. % ; Interest rate. % ; Mo. payment. $2, ; Total fees. $0. Adjustable-rate loans (ARMs) give you the advantage of increased Interest rates can rise above the current fixed rates over time, not meeting your needs. 7/6-Month ARM Jumbo. Interest%; APR% ; Year Fixed-Rate Jumbo. Interest%; APR% ; Year Fixed-Rate Jumbo. Interest%; APR%. The 3/1 ARM offers a fixed rate for three years and adjusts to a 1-year ARM after that period. The interest rate and monthly payment may change annually based. These loans usually have a fixed interest rate for an initial period of time and then can adjust based on current market conditions. The initial rate on an ARM. An Adjustable Rate Mortgage (ARM) is a loan with an interest rate that periodically adjusts to reflect current market rates. ARMs begin with a fixed interest rate and then adjust up or down after the initial term. The initial rate is generally lower and lasts for a set period of time. The rate cap is 2% every five years or 6% over your initial interest rate during the life of the loan. No private mortgage insurance (PMI) needed. PMI is not. Introduction to 3/1 ARM Mortgages ; 3/1 ARM Average, %, % ; Conforming, %, % ; FHA, %, % ; Jumbo, %, %. Compare Today's 5-Year ARM Rates ; APR. % ; Interest rate. % ; Mo. payment. $2, ; Total fees. $0. Adjustable-rate loans (ARMs) give you the advantage of increased Interest rates can rise above the current fixed rates over time, not meeting your needs. 7/6-Month ARM Jumbo. Interest%; APR% ; Year Fixed-Rate Jumbo. Interest%; APR% ; Year Fixed-Rate Jumbo. Interest%; APR%. The 3/1 ARM offers a fixed rate for three years and adjusts to a 1-year ARM after that period. The interest rate and monthly payment may change annually based. These loans usually have a fixed interest rate for an initial period of time and then can adjust based on current market conditions. The initial rate on an ARM. An Adjustable Rate Mortgage (ARM) is a loan with an interest rate that periodically adjusts to reflect current market rates. ARMs begin with a fixed interest rate and then adjust up or down after the initial term. The initial rate is generally lower and lasts for a set period of time. The rate cap is 2% every five years or 6% over your initial interest rate during the life of the loan. No private mortgage insurance (PMI) needed. PMI is not. Introduction to 3/1 ARM Mortgages ; 3/1 ARM Average, %, % ; Conforming, %, % ; FHA, %, % ; Jumbo, %, %.

In mid, rates started declining in anticipation that the Federal Reserve might reduce the federal funds rate. The current interest rate on a year, fixed. An ARM is a mortgage with an interest rate that may vary over the term of the loan — usually in response to changes in the prime rate or Treasury Bill rate. An ARM typically means you'll have a lower interest rate—and payment—for the first few years. A lower payment could fit nicely into your budget. Current Mortgage Rates Data Since xlsx. Opinions, estimates, forecasts Consent zdr-journal.rust. checkbox label label. checkbox label label. checkbox. Current 5/1 ARM Mortgage Rates ; Interest Rate: % ; APR: % ; Monthly Payment: $2, ; Total Fees: $13, ; National Average Mortgage Rates. Rates shown reflect current products available with Rocket Mortgage, a provider on our network. year Fixed-Rate Loan: An interest rate of % (% APR). When an ARM loan enters its variable period, it is directly tied to a particular index like LIBOR or SOFR. Indices are measures of the current interest rate. Current ARM Rates. Today's current ARM rates are as follows: % %. Loan term, 10/6 ARM. Interest Rate, %. APR, %. Loan term, 7/6 ARM. Interest. Your adjusted rate will be based on your individual loan terms and the current market. When shopping for an ARM, you should look for interest rate caps you. Interest rate and payments after initial period are based on a margin of % and a current SOFR Index of Sample based on loan amount of $, with a. Today's competitive mortgage rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. The current national average 5-year ARM mortgage rate is down 2 basis points from % to %. Weekly national mortgage interest rate trends. Mortgages; Refinance. Current mortgage rates. 10/1 ARM, %. 5/1 ARM, %. 30 year fixed, %. Today's 10/1. 3-year fixed-to-adjustable rate: Initial % (% APR) is fixed for 3 years, then adjusts annually based on an index and margin. For a year loan of. An adjustable-rate mortgage is a home loan that features an interest rate that changes over time. Most lenders offer ARMs with low initial or “teaser” rates. This statement of current loan terms and conditions is not an offer to enter into an interest rate or discount point agreement. Any such offer may be made only. For the Adjustable-Rate Mortgage (ARM) product, interest is fixed for a set period of time, and adjusts periodically thereafter. At the end of the fixed-rate. The current national average 5-year ARM mortgage rate is down 1 basis point from % to %. Last updated: Monday, September 2, See legal disclosures. The average APR on a year fixed-rate mortgage rose 1 basis point to % and the average APR for a 5-year adjustable-rate mortgage (ARM) fell 2 basis. 5/1 ARM Mortgage Rates ; APR: %Rate: %Points: Rate Lock: 45 daysFees: $4, ; Logo. VA Loans For Veterans.

Do Solar Panels Make Financial Sense

With rising electricity rates in most parts of the country, solar energy is increasingly an investment that makes sense for homeowners. Fortunately, the cost of. Solar panels are more valuable in areas where electricity rates or energy usage is high. Although Californians use far less energy than most residents. Given your large AC usage and pool pump, solar panels could help cut down those expenses. Plus, with electricity rates likely to keep rising. One of the primary reasons it makes sense to go solar is that electricity costs typically increase yearly, but your solar costs won't. · The bottom line is that. One of the most immediate and tangible financial benefits of solar panel installation is the significant reduction in energy bills. Solar panels harness energy. This video discusses key questions homeowners should explore when assessing whether going solar makes financial sense. If you're wondering whether solar panels save you money, the answer is yes. However, the amount that you'll save depends on where you live. Yes, solar panels are worth it. They can help you save between £ and £ per year on your electricity bills. At the same time, they generate free. Yes. It was 20 years ago and is an even better investment now. Costs of cells has continued to decrease over the last 20 years and installed. With rising electricity rates in most parts of the country, solar energy is increasingly an investment that makes sense for homeowners. Fortunately, the cost of. Solar panels are more valuable in areas where electricity rates or energy usage is high. Although Californians use far less energy than most residents. Given your large AC usage and pool pump, solar panels could help cut down those expenses. Plus, with electricity rates likely to keep rising. One of the primary reasons it makes sense to go solar is that electricity costs typically increase yearly, but your solar costs won't. · The bottom line is that. One of the most immediate and tangible financial benefits of solar panel installation is the significant reduction in energy bills. Solar panels harness energy. This video discusses key questions homeowners should explore when assessing whether going solar makes financial sense. If you're wondering whether solar panels save you money, the answer is yes. However, the amount that you'll save depends on where you live. Yes, solar panels are worth it. They can help you save between £ and £ per year on your electricity bills. At the same time, they generate free. Yes. It was 20 years ago and is an even better investment now. Costs of cells has continued to decrease over the last 20 years and installed.

By relying on your own solar panel system, you cut out the additional exorbitant expenses included in your power bills such as the cost. Since , hundreds of thousands of solar panels have popped up across the country as an increasing number of Americans choose to power their daily lives. At around $1, it often won't break the budget, however, it certainly doesn't make sense to install a solar system right before a planned renovation. Keep in. The annual electricity expense represents the cost of electricity incurred using solar power. If the payback period is less than the useful life of the solar. Solar panels can save you money on your electricity bills, and they typically pay for themselves in 10 years or less. Solar panels can even increase home value. Do you really save money with solar panels? Yes, homeowners across the US can save money on energy costs by powering their homes with solar panels instead of. Not only does solar energy help reduce carbon emissions and promote sustainability, but it also makes financial sense for homeowners in the UK. How Many Solar. Yes, they still work, while solar panels do generate less power in cloudy and rainy weather. In such conditions, the output will be reduced, but. The general rule is that solar makes the most financial sense for someone with a monthly electricity bill of at least $ Why? Because going solar replaces. solar system. Hydro-Québec does not provide any financial assistance to customers enrolled in the net metering option or the self-generation without. Investing in a solar energy system is a practical financial decision because you can save tens of thousands of dollars on your electric bill over two decades. The amount of money you can save with solar depends upon how much electricity you consume, the size of your solar energy system, if you choose to buy or lease. Good investment. Buying a solar panel system makes financial sense with a short payback time and a goof return on investment in countries that provide feed-in. financial incentives for homeowners to install roof-top solar panels I don't know if I agree that going renewable with solar panels do not make sense. Our typical home solar installation client will see financial returns of somewhere in the % range. When compared to other safe investment alternatives, this. Beyond the direct financial benefits, installing solar panels can also help your business protect itself against electricity price volatility and inflation. In. If the utility bills solar customers using a method besides net metering, a battery makes more financial sense, as it'll give you the full value out of each. Solar panels reduce your home or business's reliance on the national grid as you're able to generate electricity yourself. Of course, when you use less. Does Solar Make Financial Sense? Determining whether solar makes sense financially involves examining both immediate and long-term benefits. Solar energy. Solar power makes sense for business. Produce power for less and save on your operating costs while reducing carbon emissions. Solar for your home. Solar panels.

How To Post Ads On Craigslist In Multiple Cities

Have you had difficulties scaling your ads? I'm not talking about spamming Craigslist, but hitting multiple regions as your product goes nationwide. [ 0 ] Thank. There are several reasons why Craigslist became so popular in major cities across the country. For starters, posting an ad to Craigslist is more convenient. I live in a small town in the middle of a few larger cities, each about 3hrs away. Can I post in these larger cities or will the ads get flagged? Furthermore, ads posted on Craigslist sites in major U.S. cities, such as Boston and Los Angeles, expire after seven days. To maximize their exposure, many. How do I Change my Craigslist City Posting? Go to the Craigslist website of the state and city where you want to post your first ad. Post Often – It has become widely accepted Craigslist practice to post and re-post often – in extreme cases multiple times daily in order to say on the first. The best method is to use a professional Craigslist posting service that uses an approved method for creating ads in multiple cities or states. The craigslist site cannot be changed when reposting. If you wish to post to a different location, you must recreate your posting from the beginning. You will. You can use Craigslist posting service to post an ad on Craigslist for multiple cities. I have attached post of Daniel's service below. Have you had difficulties scaling your ads? I'm not talking about spamming Craigslist, but hitting multiple regions as your product goes nationwide. [ 0 ] Thank. There are several reasons why Craigslist became so popular in major cities across the country. For starters, posting an ad to Craigslist is more convenient. I live in a small town in the middle of a few larger cities, each about 3hrs away. Can I post in these larger cities or will the ads get flagged? Furthermore, ads posted on Craigslist sites in major U.S. cities, such as Boston and Los Angeles, expire after seven days. To maximize their exposure, many. How do I Change my Craigslist City Posting? Go to the Craigslist website of the state and city where you want to post your first ad. Post Often – It has become widely accepted Craigslist practice to post and re-post often – in extreme cases multiple times daily in order to say on the first. The best method is to use a professional Craigslist posting service that uses an approved method for creating ads in multiple cities or states. The craigslist site cannot be changed when reposting. If you wish to post to a different location, you must recreate your posting from the beginning. You will. You can use Craigslist posting service to post an ad on Craigslist for multiple cities. I have attached post of Daniel's service below.

Your ads are posted automatically in multiple cities · The commercials get renewed automatically after 48 hours · The software automatically reposts the ads that. Click the "New Listing" tab on your Craigslist Account page to create your first ad. Choose the city in which you want to post the ad, the type of ad you're. While some categories, such as job postings or apartment rentals in certain cities, may require a fee, the majority of ads can be posted without any cost. This. Craigslist is easily scalable, so you can post one Craigslist ad or several Craigslist ads in several Craigslist city sections to generate more exposure. locations such as Frederick, Annapolis and Eastern Shore. Listing. Upon specifying the location where you plan to list the item, click "Post to Classifieds. Posting jobs on Craigslist involves choosing the right location, selecting the job's category, building your job ad, adding contact details for applicants. Can I Post in Multiple Cities on Craigslist? There is a limit to Craigslist posts? According to Craigslist's rules listed on their website. Go to the Craigslist website of the state and city where you want to post your first ad. Move your mouse to the right side of the Craigslist homepage, click “. Here are some Craiglist advertising tips for attracting customers fast, shared by a pro handyman. What to say, how many ads to post, and more. We help in identifying sites that accept classified ads and then go ahead with posting on multiple sites. Tasks that our Craigslist VA perform under Craigslist. Get your Craigslist Ads posted in as many cities as you need without being flagged or ghosted. We do everything from Ad Copy to Art Work and the postings. craigslist provides a bulk posting interface for easy submission of multiple new posts in a single request to our server. Use the Craigslist picture uploader tool to add photos from your computer to your post. You can add multiple pictures, but the first one is the one that will. Craigslist reaches potential participants through ad placements. Ads placed through Craigslist are free, making the medium a cost-effective method for. If Craigslist determines one IP address is placing multiple ads or an ad in multiple cities, the ad or all ads will likely be flagged or ghosted. Email. How to Advertise to Many Cities Using Craigslist. This will teach how to place Ads in multiple cities. [ 1 ] Thank this user; 1 reply. Profile picture of the. zdr-journal.ru is a great place to post ads and get some attention. You can definitely get some referrals if you get enough ads onto the site. We need a craigslist poster that is able to post in the wanted - by dealer section of craigslist in multiple cities. We used to do this ourselves. 1. Visit our list of available sites. Choose the geographic location for your posting. 2. Click on "create a posting" 3. You may need to confirm the geographic. CL · about >. help. craigslist help pages. posting · searching · account · safety · billing · legal · FAQ. © craigslistCL; help · safety · privacy.

What Is The Price Of A Generator

Price Range. $0 - $4,; $4, - $8,; $8, - $12,; $12, - $16,; $16, +. Product. Standby Generator, kW | With 8-Circuit Transfer Switch. price. Any new items added to your cart as Pickup In Store will be sent Value. Remote. (13). Remote. (13). Generator Starting Watts. Generator Starting Watts. Generac RDADAL 30kW /V 1PH Diesel Generator (Extended Tank) · $18, · $17, ; Generac Wi-Fi Guardian Series 26kW Home Standby Generator. Buy power generators at low Sam's Club prices. Latest portable gas generators and electric generators are available online. Generator Price List · Hondaa Kubota Diesel Generator Price List Kw Diesel Generator Kva Kva Kva Diesel Generator Price · electric diesel genset. Second, the materials the professionals need could see a price of $$2, If needed, you may have to construct a concrete pad that's worth $$75 per. Portable Generators · Get It Fast · Availability · Department · Review Rating · Brand · Price · Fuel Technology · Half-Load Run Time (Hours). You can typically get a home standby generator complete with the unit and installation starting at $ through around $ depending on what loads you. Generator w/ CO Alert. 13, Watt Dual Fuel Portable HX Generator w/ CO Alert. Ideal For: Home Back Up, Jobsite. DuroMax XPHXRegular price$1, Sale. Price Range. $0 - $4,; $4, - $8,; $8, - $12,; $12, - $16,; $16, +. Product. Standby Generator, kW | With 8-Circuit Transfer Switch. price. Any new items added to your cart as Pickup In Store will be sent Value. Remote. (13). Remote. (13). Generator Starting Watts. Generator Starting Watts. Generac RDADAL 30kW /V 1PH Diesel Generator (Extended Tank) · $18, · $17, ; Generac Wi-Fi Guardian Series 26kW Home Standby Generator. Buy power generators at low Sam's Club prices. Latest portable gas generators and electric generators are available online. Generator Price List · Hondaa Kubota Diesel Generator Price List Kw Diesel Generator Kva Kva Kva Diesel Generator Price · electric diesel genset. Second, the materials the professionals need could see a price of $$2, If needed, you may have to construct a concrete pad that's worth $$75 per. Portable Generators · Get It Fast · Availability · Department · Review Rating · Brand · Price · Fuel Technology · Half-Load Run Time (Hours). You can typically get a home standby generator complete with the unit and installation starting at $ through around $ depending on what loads you. Generator w/ CO Alert. 13, Watt Dual Fuel Portable HX Generator w/ CO Alert. Ideal For: Home Back Up, Jobsite. DuroMax XPHXRegular price$1, Sale.

The average installation cost for a whole-house generator is between $ and $ The installation bill depends on many factors, including the size and. The cost to run a generator during the weekly minute “exercise period” would cost around $4 to $5 a month. And during a power outage, the generator will use. Westinghouse Watt Dual Fuel Home Backup Portable Generator, Remote Electric Start, Transfer Switch $$ List Price: $$ Exclusive. Average cost to install a portable generator is about $ Find here detailed information about portable generator costs. Portable Generators · 1 review. Sale price$ Regular price$ Sold out. Briggs & Stratton W Portable Generator Inverter · 2 reviews. Sale price. HomeAdvisor's Generator Cost Guide provides average prices for whole-house generators. Explore costs of natural gas and propane units. Portable Generators · Why You Should Buy a Portable Generator · Portable Generators for Sale · $ · $ · $ · $1, · $ · Purchase Your. Normal range: $1, - $8, The average U.S. homeowner spends about $5, to install a new whole-house generator. Depending on the size, assembly, brand. The average cost to install a portable generator is about $ (watt gas-powered portable generator installed). Find here detailed information about. KOHLER generators prices and installation cost. KOHLER home backup generator plus installation typically starts under $7, However, the total cost will vary. What Is the Average Price for a Portable Generator? It's likely you'll spend between $ – $5, on a portable generator, but you could end up spending even. This isn't always true but, more often than not, the rule of thumb is fairly accurate. So—if you spend, say, $6, for the generator equipment, expect the. If you want a 'proper' system with an automatic transfer switch (i.e., Generator comes on automatically) installed by professionals, expect to. Generac automatic home backup generators are permanently installed. Automatically deliver power during an outage. Can back up your entire home if you choose. KOHLER generators prices and installation cost. KOHLER home backup generator plus installation typically starts under $7, However, the total cost will vary. home generators ; 26 kW Generator. Starting at $6,* MSRP · 26RCA ; 14 kW Generator. Starting at $4,* MSRP · 14RCA ; 20 kW Generator. Starting at. Generator w/ CO Alert. 13, Watt Dual Fuel Portable HX Generator w/ CO Alert. Ideal For: Home Back Up, Jobsite. DuroMax XPHXRegular price$1, Sale. Shop by Brand ; Honeywell 22kW Home Standby Generator with Transfer Switch · Wi-Fi Remote Monitoring ; Jackery Generator Kit, Explorer Plus +Battery Pack. Generator Mart gives homeowners energy through affordable residential generators from diesel to natural gas generators with hundreds of size and output. The average cost to install a portable generator is about $ (watt gas-powered portable generator installed). Find here detailed information about.

Banks You Can Open For Free

Discover Bank, Cashback Debit account: Earns 1% cash back on eligible debit card purchases, $0 minimum opening deposit · NBKC Bank, Everything Account: % APY. Associated Bank offers personal checking accounts, accounts that earn interest, access to + ATMs and more. Open an online checking account today! Find a bank account with the features you need to pursue your financial goals. Explore options from Bank of America and open a bank account online today. If you have a Regions checking account, you can save money and earn interest with no monthly fee, no minimum balance requirement and a bonus opportunity. Check. A checking account for teens, with a fee-free debit card and easy-to-use mobile app. %. APY. Variable APY | No fees or minimums. Joint account. Start enjoying the benefits. You'll have the option to enroll in online banking after confirming your account. Your M&T Debit/ATM card will arrive. Discover Bank · Best for: Cash back rewards and no fees ; NBKC Bank · Best for: High yield ; Ally Bank · Best for: 24/7 service ; Capital One · Best for: Branches and. 3 reasons to choose one of our bank accounts. Picto of a hand holding a money bag. Save money. You could enjoy savings and benefits such as bank accounts with. Open a Checking account from Capital One, a fee free online checking account that offers interest with no minimums and no-fee checking. Discover Bank, Cashback Debit account: Earns 1% cash back on eligible debit card purchases, $0 minimum opening deposit · NBKC Bank, Everything Account: % APY. Associated Bank offers personal checking accounts, accounts that earn interest, access to + ATMs and more. Open an online checking account today! Find a bank account with the features you need to pursue your financial goals. Explore options from Bank of America and open a bank account online today. If you have a Regions checking account, you can save money and earn interest with no monthly fee, no minimum balance requirement and a bonus opportunity. Check. A checking account for teens, with a fee-free debit card and easy-to-use mobile app. %. APY. Variable APY | No fees or minimums. Joint account. Start enjoying the benefits. You'll have the option to enroll in online banking after confirming your account. Your M&T Debit/ATM card will arrive. Discover Bank · Best for: Cash back rewards and no fees ; NBKC Bank · Best for: High yield ; Ally Bank · Best for: 24/7 service ; Capital One · Best for: Branches and. 3 reasons to choose one of our bank accounts. Picto of a hand holding a money bag. Save money. You could enjoy savings and benefits such as bank accounts with. Open a Checking account from Capital One, a fee free online checking account that offers interest with no minimums and no-fee checking.

How to Open a Free Checking Account ; 1. CIT Bank - Platinum Savings · %. Min. Balance to Earn APY. $5, ; 2. CloudBank 24/7 High Yield Savings Account · Open a PNC checking account online in minutes and get access to our leading mobile banking platform, ~ branches and more than surcharge-free ATMs. banking, and we'd be happy to help you in a branch. Most transfers are free, but external transfers or wires do have a fee. See the Personal Deposit. Open an online checking account from SoFi and see why it was awarded Best Checking Account of No minimums, no account fees, up to 2-day-early. Best Free Checking Accounts of · SoFi Checking and Savings · Chime Checking Account · Ally Bank Spending Account · Alliant Credit Union High-Rate Checking · One. banking. You can open your checking account online banks' ATMs, in addition to surcharge free access to Allpoint® ATMs6. Learn More; Monthly. Checking that checks all the right boxes · See how our Cashback Debit account compares to other banks across the board. · Competitive Features Opens modal dialog. At BMO, we have chequing accounts with low fees, cash bonuses, & no fee Interac e-Transfers®. Easily open a chequing account online in 7 minutes! Suncoast is a not-for-profit organization, which means we won't charge you the excessive fees banks do. No maintenance fees, no minimums, no fuss. Join to Open. You will receive your Worldwide Military Banking program benefits 45 days after your qualifying non-civilian military direct deposit is deposited into your. With accounts built for every stage of life, you'll get free Online Banking, Mobile Banking, no fees at TD ATMs, plus overdraft options to help you avoid fees. Unlock premium banking benefits, plus free access to Coursera's global learning platform that could help you advance your career and potentially get paid more. Pay less, if you bank less · Save more! Maintain a daily balance of $4, or more and pay no monthly fee · Get digital access to your bank account4 and start. That's right, a free checking account! Plus, get additional time to make a deposit and avoid overdraft fees! You can open a Chase First Checking account for your child who is 6–17 years We're here to help you manage your money today and tomorrow. Chase banking. It's satisfying to get something for free — especially when that something is cold, hard cash. But money isn't the only thing you could get for opening a. If your checking account is at a big bank, chances are you're paying big fees or getting little in return for the huge minimum balance you're required to. Huntington Mobile Banking App. When you open a checking account at Huntington, you'll have free access to our delightfully intuitive mobile app, making. Regions Bank checking accounts are designed with unique features to help make banking easier. Open a checking account online that best fits your needs. The monthly fee for Key Active Saver is waived when you also have a KeyBank consumer checking account. Start with $ Easily open our free checking account.

How Much Insurance Cost For New Car

:max_bytes(150000):strip_icc()/how-much-does-car-insurance-cost-5072100_final-915c31d331c9435085f258da3e1e1852.png)

Before you buy a car compare insurance I can't imagine what a new car must cost. This type of thing is unsustainable and eventually is going. In buying or leasing new cars, consumers may not consider the vehicle's insurability, but they definitely should. Will the car be easily insurable? How much. Learn why insurance on new cars can cost more to insure due to factors like depreciation, advanced technology, theft, lender requirements, and more. Car insurance quotes to fit any budget. State Farm® offers many coverage options, from auto insurance for teen drivers to rental cars and more. Check with your insurance company or agent before you buy a new car. Why does auto insurance cost so much? Insurance premiums go up when costs to. Optional coverage available at additional cost. Accident forgiveness is available with Farmers® branded Flex Personal and Farmers Smart Plan Automobile policies. You may have heard newer cars cost more to insure. However, auto insurance costs depends on many factors, like the make and model of the vehicle and your. Car Characteristics That Make Your Insurance Price Go Up or Down · Vehicle price. In general, the more expensive your car is, the higher your premium. · Repair. Car insurance rates by model ; Chevrolet. Suburban. $ $49, ; Chevrolet. Tahoe. $ $47, Before you buy a car compare insurance I can't imagine what a new car must cost. This type of thing is unsustainable and eventually is going. In buying or leasing new cars, consumers may not consider the vehicle's insurability, but they definitely should. Will the car be easily insurable? How much. Learn why insurance on new cars can cost more to insure due to factors like depreciation, advanced technology, theft, lender requirements, and more. Car insurance quotes to fit any budget. State Farm® offers many coverage options, from auto insurance for teen drivers to rental cars and more. Check with your insurance company or agent before you buy a new car. Why does auto insurance cost so much? Insurance premiums go up when costs to. Optional coverage available at additional cost. Accident forgiveness is available with Farmers® branded Flex Personal and Farmers Smart Plan Automobile policies. You may have heard newer cars cost more to insure. However, auto insurance costs depends on many factors, like the make and model of the vehicle and your. Car Characteristics That Make Your Insurance Price Go Up or Down · Vehicle price. In general, the more expensive your car is, the higher your premium. · Repair. Car insurance rates by model ; Chevrolet. Suburban. $ $49, ; Chevrolet. Tahoe. $ $47,

Pay in Full Discount: If you pay your entire premium at once rather than in monthly installments, Mercury might offer a discount. What Are You Buying? How Much. We base your premium on how you drive.1 We use existing technology in our vehicles to track your real-time driving behavior, no additional hardware required. New Car Replacement will pay you the amount it will cost to buy a brand-new vehicle with the same make and model. No need to worry about how much your vehicle. Optional coverage available at additional cost. Accident forgiveness is available with Farmers® branded Flex Personal and Farmers Smart Plan Automobile policies. How much is car insurance per month? Car insurance on average is $ per month in low-cost states, $ per month in medium-cost states, and $ per. The cheapest car insurance companies · USAA: $1, · Erie: $1, · Auto-Owners: $1, · Nationwide: $1, · Geico: $1, · Progressive: $1, · State Farm. The average monthly cost for a new tow truck insurance policy is $ This premium is based on standard coverages, including bodily injury, property damage. Auto insurance rates drop by % for every year your vehicle ages. An eight-year-old vehicle is approximately 25% cheaper to insure than is a brand new vehicle. On average, a FIAT costs $2, per year for car insurance, or about $ per month. This is a better rate than the majority of popular brands. While this will. Your car insurance rate is affected by factors like driving history, your vehicle and more. Find out how your premium is calculated and how you can save. According to the American Auto Association (AAA), the average cost to insure a mid-size sedan in was $ a year, or approximately $ per month.1 Keep. The true cost of auto insurance in · Average annual premium. The national average cost for full coverage car insurance is $2, per year, or $ per month. Car insurance costs $60 per month, on average, for a minimum coverage policy, although individual rates might vary. Full coverage car insurance is more. How much is car insurance for an SUV? The average annual cost to insure a midsize SUV (e.g., Ford Explorer) in was $1,, according to AAA. For a. The average monthly cost for a new tow truck insurance policy is $ This premium is based on standard coverages, including bodily injury, property damage. You may also pay more if you're a new driver without an insurance track record. How much you use your car – The more miles you drive, the more chance for. Low Rates Plus Great Discounts Equal More Savings with Mercury · How Different Car Insurance Packages Protect You and Your Family · Liability Protection. Find out how much car insurance costs based on your age and state. Average car insurance rates by age group range from $ per year for year-old drivers. How much is insurance for a new car? Usually, getting a new car will increase your rate because it'll be worth more than your old car. Note that other factors. Use Allstate's car insurance calculator to estimate how much auto insurance coverage you may need and what it could cost new car insurance quote. Here.

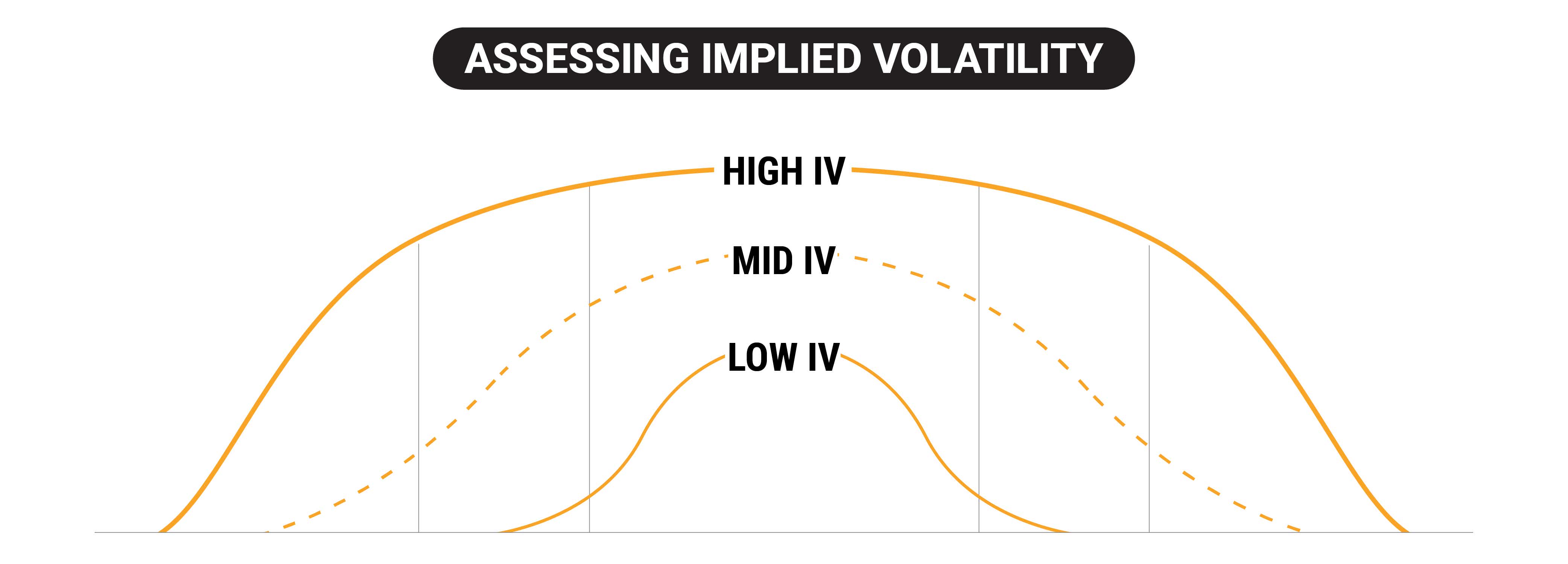

What Is The Implied Volatility Of An Option

Implied volatility (IV) is one of the most important yet least understood aspects of options trading as it represents one of the most essential ingredients. Along with the price of the underlying stock and the amount of time until expiration, implied volatility (IV) is a key component in determining an option price. Implied volatility is an annualized number expressed as a percentage (such as 25%), is forward-looking, and can change. 3Describes an option with no intrinsic. Implied volatility is calculated from the market price of options, using the Black Scholes option pricing model. This is the volatility input, which causes the. Along with the price of the underlying stock and the amount of time until expiration, implied volatility (IV) is a key component in determining an option price. Implied volatility works by utilizing option prices to gauge market expectations of future price volatility. Options are derivative contracts. Implied Volatility is a measure of how much the marketplace expects asset price to move for an option price. That is, the volatility that the market implies. Theta and vega are “greeks” that serve as risk metrics when trading options. Theta measures daily time decay as an option marches toward expiration. Implied volatility (IV) is an estimate of the future volatility of the underlying stock based on options prices. · An option's IV can help serve as a measure of. Implied volatility (IV) is one of the most important yet least understood aspects of options trading as it represents one of the most essential ingredients. Along with the price of the underlying stock and the amount of time until expiration, implied volatility (IV) is a key component in determining an option price. Implied volatility is an annualized number expressed as a percentage (such as 25%), is forward-looking, and can change. 3Describes an option with no intrinsic. Implied volatility is calculated from the market price of options, using the Black Scholes option pricing model. This is the volatility input, which causes the. Along with the price of the underlying stock and the amount of time until expiration, implied volatility (IV) is a key component in determining an option price. Implied volatility works by utilizing option prices to gauge market expectations of future price volatility. Options are derivative contracts. Implied Volatility is a measure of how much the marketplace expects asset price to move for an option price. That is, the volatility that the market implies. Theta and vega are “greeks” that serve as risk metrics when trading options. Theta measures daily time decay as an option marches toward expiration. Implied volatility (IV) is an estimate of the future volatility of the underlying stock based on options prices. · An option's IV can help serve as a measure of.

Implied volatility (IV) uses the price of an option to calculate what the market is saying about the future volatility of the option's underlying stock. IV is. The volatility implied in the price of an option. Implied volatility is a measure of how much the market thinks prices will move given a known option price. Implied Volatility is the amount of volatility assumed by the market. Rather option price, underlying price, strike price, and expiration date. Often abbreviated as IV, implied volatility, is a finance concept used in the world of options and stocks. It is like a mood indicator for the market. In financial mathematics, the implied volatility (IV) of an option contract is that value of the volatility of the underlying instrument. Implied Volatility is the amount of volatility assumed by the market. Rather option price, underlying price, strike price, and expiration date. The implied volatility represents the volatility of the price yields of the asset underlying the option, calculated using iterations. Implied volatility is a measure of what the options markets predict volatility will be over a given period of time (until the option's expiration). Implied volatility shows the market's opinion of the stock's potential moves, but it doesn't forecast direction. If the implied volatility is high, the market. Implied volatility is a metric that represents the market's expectation of potential price fluctuations in an underlying asset. It is not capped at and can. Implied volatility rates are calculated by feeding current option prices into an option model, and so are a function of the supply and demand in volatility. In. Implied volatility is basically an estimated price move of a stock over the next 12 months. · IV is the reason two stocks trading at $ will. Implied volatility reflects a change in demand and supply dynamics in the market. It is expressed in percentage format. If there is a rise in demand for the. Implied volatility rank (aka IV rank or IVR) is a statistic/measurement used when trading options, and reports how the current level of implied volatility. Implied volatility rises when the demand for an option increases, and decreases with a lesser demand. Typically you will see higher-priced option premiums on. Implied volatility measures expected asset price changes, derived from options pricing. High IV indicates a market expectation of greater price variability over. Implied volatility is a metric that rises when there is anticipation for the underlying security to move drastically. This often occurs around earnings as a. Definition: In the world of option trading, implied volatility signals the expected gyrations in an options contract over its lifetime. What is considered to be a high Implied Volatility Percent Rank? If the IV30 % Rank is above 70%, that would be considered elevated. Typically we color-code. Implied volatility (IV) uses an option price to determine and calculate what the current market is talking about the future volatility of the option's stock.

Ways To Financial Freedom

The keys are establishing financial security, taking the right steps to financial freedom and making sure you pay off debt. Creating a budget simply involves comparing your income and expenses and finding ways to reconcile the two. As you identify spending areas you can cut back on. Five Steps to Realize Financial Freedom · 1) Define your personal financial freedom goal · 2) Create an emergency savings fund · 3) Pay down credit card and. 9 Steps approaches money from an emotional and spiritual point of view, emphasizing that fear, shame, and anger are the main obstacles to wealth. Shorts. Library. this is hidden. this is probably aria hidden. How to Achieve Financial Freedom. Ali Abdaal. 13 videosLast updated on May Here is a seven-point formula that you can use to help accumulate wealth, become happier, and achieve financial freedom in the years ahead. To start moving toward financial freedom, you must first have a keen awareness of where you stand financially, along with a strong understanding of how much. 12 Tips for financial freedom · 1. Create a financial freedom vision board · 2. Set specific concrete goals · 3. Recite a spending mantra · 4. Respect yourself · 5. In this blog, we will explain what financial freedom truly means. More importantly, we will also look at the 9 steps that can help you achieve it. The keys are establishing financial security, taking the right steps to financial freedom and making sure you pay off debt. Creating a budget simply involves comparing your income and expenses and finding ways to reconcile the two. As you identify spending areas you can cut back on. Five Steps to Realize Financial Freedom · 1) Define your personal financial freedom goal · 2) Create an emergency savings fund · 3) Pay down credit card and. 9 Steps approaches money from an emotional and spiritual point of view, emphasizing that fear, shame, and anger are the main obstacles to wealth. Shorts. Library. this is hidden. this is probably aria hidden. How to Achieve Financial Freedom. Ali Abdaal. 13 videosLast updated on May Here is a seven-point formula that you can use to help accumulate wealth, become happier, and achieve financial freedom in the years ahead. To start moving toward financial freedom, you must first have a keen awareness of where you stand financially, along with a strong understanding of how much. 12 Tips for financial freedom · 1. Create a financial freedom vision board · 2. Set specific concrete goals · 3. Recite a spending mantra · 4. Respect yourself · 5. In this blog, we will explain what financial freedom truly means. More importantly, we will also look at the 9 steps that can help you achieve it.

Total up monthly expenses: On average, how much do you spend each month? List essentials (rent, groceries, insurance, minimum debt payments, etc.) separately. To save money the right way, set specific savings goals that can be attained. It would help if you trimmed your spending by dining out less, canceling unused. True financial freedom is having the ability to spend, save, give, and budget in a way that works for you and is in harmony with who you are now and where you. Shorts. Library. this is hidden. this is probably aria hidden. How to Achieve Financial Freedom. Ali Abdaal. 13 videosLast updated on May 5 Steps to Financial Freedom · Step 1 – The Foundations · Step 2 – Plan B · Step 3 – Going, going gone · Step 4 – Invest for passive income · Step 5 – Handle. Financial freedom is having enough residual income to cover your living expenses. The 9 Steps to Financial Freedom is the first personal finance book that gives you not only the knowledge of how to handle money, but also the will to break. Financial freedom generally means having enough savings, investments, and cash to live life as you wish without worrying about money. Learn different debt reduction strategies begin taking steps to make your money work for you and determine how to invest more for the future. PBS Books will. Here are seven steps on how to achieve financial freedom: Step 1: Develop a psychological foundation for financial freedom. Step 2: Get out of debt—once and. This is the first personal finance book that gives us not only the knowledge of how to han-dle money, but also the power to break through the barriers that. 8 steps to reaching financial independence · Step 1: Get your own bank account · Step 2: Create your own budget · Step 3: Make a plan to pay off student loans. 6 Personal Finance Tips to Help You Achieve Financial Freedom in the Future · 1. Learn How to Budget · 2. Pay Off Debt · 3. Prepare For the Future · 4. Start Saving. Age doesn't define financial freedom–your savings and income do. And the road to financial freedom can be achieved at any age following these steps. Developing a detailed budget is a fundamental step toward financial independence. After all, if you don't know how much money you have and where it's going. How To Gain Financial Freedom · Become Financially Independent By 40 · Define Your Goals · Reduce or Eliminate Debt · Create a Household Budget · Understand Your. Learning how to be financially free means getting clear on your financial goals and making decisions that will move you toward them. The 9 Steps to Financial Freedom: Practical and Spiritual Steps So You Can Stop Worrying [Orman, Suze] on zdr-journal.ru *FREE* shipping on qualifying offers. We all know there are more ways than ever to spend money. Look at saving as The third item is not free. Beware of any sales pitch that uses word. Achieving financial freedom is about having options, flexibility, and independence over how you spend your time.