zdr-journal.ru

Learn

Book Translation Cost

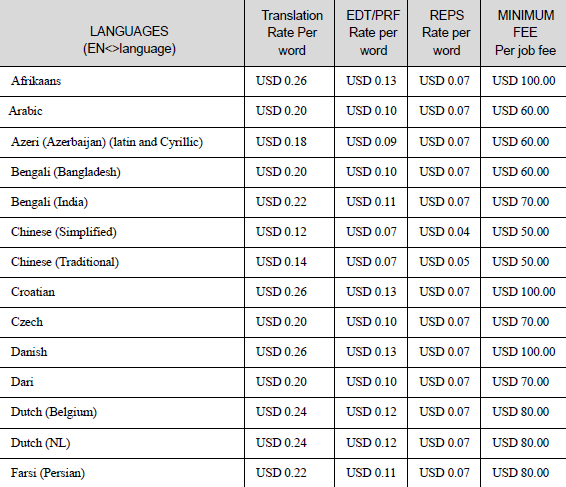

In this article, we will explore the different costs associated with book translation and provide insights into what you can expect to pay for high-quality. Total costs may vary depending on numerous factors. Those factors span volume density, complexity of text, language pair, and urgency. However, we promise the. The translation of a standard page costs on average US $25, considering an average of words per page, or 1, characters including spaces. Three levels of. What is the average cost for translation per word? We translate documents 24/7 translation; Support Login Book and Manuscript · Business Documents · Contract · Cover Letter · CV · Death. The price per word for translations in the United States typically ranges from $ to $ For example, a document that contains 1, words will likely. The range varies widely based on the conditions we saw above and varies from US$/word to US$/word. For a better idea of what might be the right cost. They are charged at a standard translation rate, starting from $ to $ per word. 3- Marketing Material: These are the marketing campaign assets companies. The standard translation cost for an A4 sheet with 70% text will cost around $ Meanwhile, the specialized translation cost for an A4 sheet with 70% text. In this article, we will explore the different costs associated with book translation and provide insights into what you can expect to pay for high-quality. Total costs may vary depending on numerous factors. Those factors span volume density, complexity of text, language pair, and urgency. However, we promise the. The translation of a standard page costs on average US $25, considering an average of words per page, or 1, characters including spaces. Three levels of. What is the average cost for translation per word? We translate documents 24/7 translation; Support Login Book and Manuscript · Business Documents · Contract · Cover Letter · CV · Death. The price per word for translations in the United States typically ranges from $ to $ For example, a document that contains 1, words will likely. The range varies widely based on the conditions we saw above and varies from US$/word to US$/word. For a better idea of what might be the right cost. They are charged at a standard translation rate, starting from $ to $ per word. 3- Marketing Material: These are the marketing campaign assets companies. The standard translation cost for an A4 sheet with 70% text will cost around $ Meanwhile, the specialized translation cost for an A4 sheet with 70% text.

While the average cost of professional translation services can range from $ to $ per word, the final cost will be based on the number of services. Having worked as a Project Manager for several years with extensive cooperation with hundreds of other freelance translators, I'd say roughly there's a fairly. Book of World Records), it means we get more of them in our character line (with spaces). On average, English text: 1 line = roughly 9 or 10 words. In. That is why Protranslate is able to cut off its book translation services' cost. Protranslate book translation office is especially proud of its book. Typically, costs can range in between cents per word to cents per word, and some translation service providers are entitled to charge their clients a. Book translation in 3 simple steps · 1. Get pricing · 2. Upload your manuscript · 3. Connect with global readers. Consider the translation of technical product sheets, each of about 50 words, with a 35% repetition rate. For a total volume of 50, words, only 32, Translators charge $$ per word; $$40 per hour. Language pair, project complexity, urgency, & volume, contribute to rates. The average rate for per word translation is $ per word. This means that a words document's translation cost is $ It is important to understand that. Translator hourly rates in the United States in range in average from $30 to $70 per hour depending on language combination, volume, turnaround, and. The language industry prices translation work using word counts. On average, a professional translator can translate between 2,, words a day (8. Nationally the average document translation cost is around $ per word throughout the United States. Southeast Spanish charges less than $ per word in. We offer the best prices in the translation market. For general subject and small projects (less than 10 words) we charge from as low as USD per. The rate varies depending on the word count, text complexity, formatting and number of translators available. The rate per word varies from $ to $ which. Practical Examples of Translation Cost Per Word ; Language Pair. Price per word*: Personal Content. Price per word*: Business Document ; English to Chinese. $ This ensures a high-quality translation. Translate book. Book translation: quick and cost-efficient. Via our online platform, you start your book translation If you need translation within 24 hours of placing an order, you will be charged INR (For Indian language) and INR (For Foreign languages) additional. Frequently Asked Questions. Q. How much does it cost to get a book translated? +. But what about the price of translating one page? Not everyone knows that the actual per-page prices of authentic, quality professional translations also vary.

Risk Intelligence Test

Risk intelligence is a concept that generally means "beyond risk management", though it has been used in different ways by different writers. What do you like best about Orion Risk Intelligence? The stress test is an exceptional tool to demonstrate portfolio reaction to potential adverse market. The questions on this test are designed to determine your level of comfort with risk-taking, and how it could affect your career. GCTI with CyberLive. GIAC knows that cyber security professionals need: Discipline-specific certifications; Practical testing that validates their knowledge and. A trusted and independent provider of data intelligence for Anti-Money Laundering, Anti-Corruption and Cybersecurity professionals. Cyber risk is complex, attackers are motivated and dynamic, changing and evolving their techniques. Financial institutions are required to test and exercise to. Whether you want to enter new markets, stress test business scenarios, or Risk Intelligence Quantified (Risk IQ). Dynamic risks can be difficult to. Aug 23, | Amid a transition said to be bigger than T+1, new providers prepare to move in, and Financial Markets. Advertisement. PODCAST. Stress Testing. Projection Point focuses its efforts in risk analysis, consulting and behavioural testing where it can make a major positive impact on key decision makers. Risk intelligence is a concept that generally means "beyond risk management", though it has been used in different ways by different writers. What do you like best about Orion Risk Intelligence? The stress test is an exceptional tool to demonstrate portfolio reaction to potential adverse market. The questions on this test are designed to determine your level of comfort with risk-taking, and how it could affect your career. GCTI with CyberLive. GIAC knows that cyber security professionals need: Discipline-specific certifications; Practical testing that validates their knowledge and. A trusted and independent provider of data intelligence for Anti-Money Laundering, Anti-Corruption and Cybersecurity professionals. Cyber risk is complex, attackers are motivated and dynamic, changing and evolving their techniques. Financial institutions are required to test and exercise to. Whether you want to enter new markets, stress test business scenarios, or Risk Intelligence Quantified (Risk IQ). Dynamic risks can be difficult to. Aug 23, | Amid a transition said to be bigger than T+1, new providers prepare to move in, and Financial Markets. Advertisement. PODCAST. Stress Testing. Projection Point focuses its efforts in risk analysis, consulting and behavioural testing where it can make a major positive impact on key decision makers.

Start risk conversations off right with next-level business intelligence, stress testing and analysis that builds trust and spurs growth for your business. Create a test plan in Risk Workspace · Filter data in the risk heatmap workbench · Define the risk appetite for an entity · Risk appetite fields on the Entity. Third party risk intelligence is a threat intelligence service that provides you with real-time insight into cyber threats and other forms of digital risk. Cyber threat intelligence refers to actionable information about cyber threats, which reaches the security team after processing data and classification. Risk intelligence involves crunching the data with your brain. You absorb the data by reading, watching, and listening, and then you mull it over in your head. Corsa Technology selected Keysight's BreakingPoint network security test solution due to our regular ATI updates of the latest attack signatures, extensive. Discover how risk intelligent you are and give us your feedback. About Acuris Risk Intelligence. Products & Services. Third-Party Risk · Anti-Money Laundering · Cybersecurity · Acuris Cybercheck. News & Press Releases. Those who successfully complete the final exam will be awarded the arcX Foundation Level Threat Intelligence Analyst (FTIA) certification. This course is not a. SeaLights Quality Intelligence analyzes test execution data and correlates it with changes to the codebase and actual production usage. The Association of International Risk Intelligence Professionals (AIRIP) is a (c)(6) nonprofit professional association that empowers members to unlock the. Building strong security risk management. Risk Intelligence's risk assessments contain in-depth analyses of existing or forecasted threats for specific client. Test your risk intelligence! Take Risk Survey. 1. What is the main goal for your investments? a We will use this information to run a stress test analysis on your investments. Subjective Risk Intelligence is defined as the capacity of a person to effectively assess the pros and cons of a decision in situations in which not all. 3D Risk Profile. Run Stress Testing & Risk Analytics. Strategize based on goals and market realities, and show upside and downside risk. Compare your model. To test a threat intelligence decoy, after the decoy web page appears, verify that it matches the application you selected while creating the decoy. Develop and test response plans for various potential threats. This feature Risk Intelligence Suite · Public Alerting · Integrations. Resources. Blog. Evans has spearheaded the study of risk intelligence, devising a simple test to measure a person's RQ which when posted online sparked a storm of interest. Risk Intelligence Threat Assessment security. Frequently Asked Do you offer a free trial or test of the Risk Intelligence services? Samples.

The Science Of Confidence

Confidence is a belief in oneself, the conviction that one has the ability to meet life's challenges and to succeed—and the willingness to act accordingly. Christian Scientists soon learn that confidence in one's own ability, our human sense of strength, human will-power and determination, is misplaced. At the core of confidence lies our brain's intricate chemistry. Neurotransmitters like dopamine play a vital role here. Dopamine is often called the 'feel-good'. Ian told us that confidence is simply, "the belief that you can do something", and we hope you'll be inspired to explore, experiment, and let us know what. Confidence is something that can be developed, taught, a habit that can be created, and mental state that can be honed to perfection. Tracy does a great job of. An increase in self-confidence in women could help to break this barrier towards a greater female participation in STEM. "The Confidence Code" brings up some really poignant psychological, genetic and social observations about how we as women behave and treat power, and it's an. The Mel Robbins Podcast: Toolkit for Building Unstoppable Confidence (According to Research). In this episode, you are getting a brand new definition of. The Science of Self-Confidence [Brian Tracy] on zdr-journal.ru *FREE* shipping on qualifying offers. The Science of Self-Confidence. Confidence is a belief in oneself, the conviction that one has the ability to meet life's challenges and to succeed—and the willingness to act accordingly. Christian Scientists soon learn that confidence in one's own ability, our human sense of strength, human will-power and determination, is misplaced. At the core of confidence lies our brain's intricate chemistry. Neurotransmitters like dopamine play a vital role here. Dopamine is often called the 'feel-good'. Ian told us that confidence is simply, "the belief that you can do something", and we hope you'll be inspired to explore, experiment, and let us know what. Confidence is something that can be developed, taught, a habit that can be created, and mental state that can be honed to perfection. Tracy does a great job of. An increase in self-confidence in women could help to break this barrier towards a greater female participation in STEM. "The Confidence Code" brings up some really poignant psychological, genetic and social observations about how we as women behave and treat power, and it's an. The Mel Robbins Podcast: Toolkit for Building Unstoppable Confidence (According to Research). In this episode, you are getting a brand new definition of. The Science of Self-Confidence [Brian Tracy] on zdr-journal.ru *FREE* shipping on qualifying offers. The Science of Self-Confidence.

Our unjustified self-assurance is well-documented in psychology (sometimes called the “overconfidence effect”). But confidence is nuanced. It's. What's the best way to get a quick boost of confidence, right when you need it most? And how can you keep it for the long run? Read on. Learn strategies to boost self-esteem and develop a positive mindset. Explore the Confidence Course Catalog. Listen to this episode from The Mel Robbins Podcast on Spotify. In this episode, you are getting a brand new definition of confidence. What is self-confidence? How does it differ from self-esteem? Discover the main scientific theories and learn how to build it for wellbeing. About The Confidence Code is a book that examines the power of confidence and how it can help women reach their goals. Through the captivat by Katty Kay. GrowthDay Confidence Masterclass will help anyone overcome their fears and self-doubts, help reduce their stress, and finally find the inner strength and. Confidence is something that can be developed, taught, a habit that can be created, and mental state that can be honed to perfection. Tracy does a great job of. How to Break the Habit of Self-Doubt and Build Real Confidence · 16 Video lessons in HD · 5h 8m of class content · Exclusive bonus content · Lifetime access. Mental Fitness Research Assistant Rea Gill explains the links between confidence and achieving in education, outlining the benefits the key skill of mental. How to Build Rock Solid Self-Confidence and Achieve All of Your Goals. A spectrum of pathways to attain rigor and confidence in scientific knowledge, beginning with an overview of research synthesis and meta-analysis. A proven system for developing the confidence you need to take the necessary steps toward achieving your biggest, most important goals. Self-confidence is defined as, the belief that you can successfully perform a desired behavior (Weinberg & Gould, ). Athletes that allow the smallest amount. The best way to get that belief is through using your skills and talents — by learning and practicing. Confidence helps us move forward to discover and develop. Eventbrite - Mindspring Mental Health Alliance presents The Science Behind Self-Confidence [Free Webinar] - Wednesday, March 13, - Find event and. Self-confidence is defined as, the belief that you can successfully perform a desired behavior (Weinberg & Gould, ). Athletes that allow the smallest amount. Achieve - The Science of Confidence “Whether you believe you can do a thing or not, you are right.” HENRY FORD. Clinical psychologist and neuroscientist Professor Ian Robertson tells us how confidence plays out in our minds, our brains and indeed our bodies. Self-confidence is trust in oneself. Self-confidence involves a positive belief that one can generally accomplish what one wishes to do in the future.

Property Investment Platforms

Best for rental investing: Roofstock · Best for REIT and private deals: RealtyMogul · Best for individual property investments: Ark7 · Best for large private funds. CrowdStreet is one of the leading commercial real estate investing platforms. Thousands of investors use CrowdStreet to invest in commercial real estate. Our. Our platform connects individual investors with diverse investment opportunities from experienced CRE firms from around the country. We are a global leader in real estate investing. We utilize our expertise to manage properties responsibly and generate returns for investors. Among the most notable benefits of real estate crowdfunding is that it allows you to engage in portfolio diversification. By diversifying your portfolio, you. CapitalRise Property investment platform CapitalRise is a property investment platform enabling investors to sidestep the middlemen and invest directly in. Compare the Best Real Estate Investing Apps · RealtyMogul · Fundrise · Yieldstreet · Groundfloor · EquityMultiple · CrowdStreet · DiversyFund · Arrived. Best. Vairt is the Best Real Estate Investment Platform brings the investment plans with exceptional returns. Enjoy the benefits of fractional real estate investing with just $ Our automatic investing platform makes it easier than ever to diversify your portfolio. Best for rental investing: Roofstock · Best for REIT and private deals: RealtyMogul · Best for individual property investments: Ark7 · Best for large private funds. CrowdStreet is one of the leading commercial real estate investing platforms. Thousands of investors use CrowdStreet to invest in commercial real estate. Our. Our platform connects individual investors with diverse investment opportunities from experienced CRE firms from around the country. We are a global leader in real estate investing. We utilize our expertise to manage properties responsibly and generate returns for investors. Among the most notable benefits of real estate crowdfunding is that it allows you to engage in portfolio diversification. By diversifying your portfolio, you. CapitalRise Property investment platform CapitalRise is a property investment platform enabling investors to sidestep the middlemen and invest directly in. Compare the Best Real Estate Investing Apps · RealtyMogul · Fundrise · Yieldstreet · Groundfloor · EquityMultiple · CrowdStreet · DiversyFund · Arrived. Best. Vairt is the Best Real Estate Investment Platform brings the investment plans with exceptional returns. Enjoy the benefits of fractional real estate investing with just $ Our automatic investing platform makes it easier than ever to diversify your portfolio.

Bricksave is a state-of-the-art crowdfunding platform providing direct access to secure, asset-backed investment opportunities hand-picked from across the globe. Discover top real estate investment opportunities with Landa, the premier platform for real estate investing. Elevate your real estate portfolio. Leading Real Estate Crowdfunding Platforms · RealtyMogul: It is a well-established real estate crowdfunding platform offering various investment opportunities in. How to choose a good real estate crowdfunding platform? · EstateGuru · Reinvest24 · Kirsan Invest · Crowdpear · Indemo · To Sum Up. Arrived is a platform for easily investing in Real Estate, starting from $ Invest in rental properties, earn passive income, and let Arrived take care. Crowdstreet has traditionally had the largest # of deals to choose from (although at the moment has just a handful). This can give an investor an idea of the. Looking to build and protect your wealth? Origin Investment's best-in-class private real estate investments can help. Get started today. RealtyMogul lets investors browse, conduct due diligence, invest and track the performance of their investments through an online dashboard. List of Real estate crowdfunding platforms in United Kingdom · Engel & Völkers Digital Invest · REALTY BUNDLES · Crowd With Us · EstateGuru · JaeVee · Shojin. Invest in real estate online and buy shares in rental properties. Earn passive income through Ark7 with no hassle. Looking to diversify your portfolio? We rounded up the best real estate crowdfunding investment platforms of , allowing as little as $1. The first real estate investment platform that gives you access to high-yield, short-term loans. Real estate debt investing has never been easier. Exchange Properties At Your Fingertips. The Crowdfunding portal allows investors to find, explore, identify, and invest in institutional real estate. Buy fractional real estate from across the U.S.A. Get paid rent daily and watch your holdings appreciate. Invest in under 5 minutes. We are much more than a property crowdfunding platform that simply acts as a conduit for investing. Brickowner is a service, that aims to monitor. Partners' real estate investment platform specializes in the acquisition, disposition, development of, and capital raising for office, industrial, and retail. Small Change is an online real estate crowdfunding and investment portal that makes cities better. Turn Small Change into real change. Fundrise is my favorite platform because they have diversified funds that invest in residential and industrial properties in the Sunbelt. For most people. Integrated Investment Platforms ·. Real Estate. Cerberus is a leading global investor in real estate and real estate-related assets. With extensive experience. Agora is dedicated to enabling real estate firms to realize their full potential by providing them with a comprehensive, flexible, and easy solution to.

Leveraged Stock Funds

:max_bytes(150000):strip_icc()/What_Is_Financial_Leverage-2e972f832d4749c9aa5302353cdec52f.jpg)

Fixed income investments entail interest rate risk (as interest rates rise bond prices usually fall), the risk of issuer default, issuer credit risk and. By using these derivatives, fund issuers can multiply the volatility of the asset compared to the index it tracks. For example, a leveraged ETF tracking the. For professional investors, leveraged ETFs are useful in statistical arbitrage, short-term tactical strategies, and for use as short-term hedges without the. Leveraged products are often identified with a multiplier in their names, such as "2x" or "3x," or may have a fund-specific description such as "ultra." These. To attain this ratio, a leveraged ETF can use financial derivatives and debt. This magnifying effect goes both ways. With a gain of 1%, a leveraged ETF will. Leveraged ETF (2x and with a broad diversified index underlying index like the S&P , not something like TQQQ or TECL etc.) can be decent. Leveraged equity mutual funds and ETFs are designed to offer magnified exposure to movements in either individual stocks or the broader equity market. A leveraged ETF uses derivative contracts to magnify the daily gains of an index or benchmark. These funds can offer high returns, but they also come with high. Leveraged ETFs are powerful and complex trading instruments that allow traders to magnify the return on investment. While higher returns are an attractive. Fixed income investments entail interest rate risk (as interest rates rise bond prices usually fall), the risk of issuer default, issuer credit risk and. By using these derivatives, fund issuers can multiply the volatility of the asset compared to the index it tracks. For example, a leveraged ETF tracking the. For professional investors, leveraged ETFs are useful in statistical arbitrage, short-term tactical strategies, and for use as short-term hedges without the. Leveraged products are often identified with a multiplier in their names, such as "2x" or "3x," or may have a fund-specific description such as "ultra." These. To attain this ratio, a leveraged ETF can use financial derivatives and debt. This magnifying effect goes both ways. With a gain of 1%, a leveraged ETF will. Leveraged ETF (2x and with a broad diversified index underlying index like the S&P , not something like TQQQ or TECL etc.) can be decent. Leveraged equity mutual funds and ETFs are designed to offer magnified exposure to movements in either individual stocks or the broader equity market. A leveraged ETF uses derivative contracts to magnify the daily gains of an index or benchmark. These funds can offer high returns, but they also come with high. Leveraged ETFs are powerful and complex trading instruments that allow traders to magnify the return on investment. While higher returns are an attractive.

Direxion Leveraged Exchange Traded Funds (ETFs) are daily funds that provide %, % or % leverage or inverse leverage and the ability for investors to. Some funds may include significant acquired fund fees and expenses incurred indirectly through the fund's ownership of shares in other investment companies. Leveraged ETFs are designed for short-term trading. They are not intended for long-term investment strategies or buy-and-hold approaches. Holding leveraged ETFs. Unlike mutual funds, shares of ETFs are not individually redeemable directly with the ETF. Shares are bought and sold at market price, which may be higher or. Leveraged and Inverse ETFs pursue daily leveraged investment objectives which means they are riskier than alternatives which do not use leverage. They seek. Leveraged Exchange-Traded Funds (LETFs) are publicly-traded funds that promise to provide daily returns that are in a multiple (positive or negative) of the. Leveraged ETF (2x and with a broad diversified index underlying index like the S&P , not something like TQQQ or TECL etc.) can be decent. Inverse ETFs seek to provide the opposite of the investment returns, also daily, of a given index or benchmark, either in whole or by multiples. Due to the. A leveraged ETF is an exchange-traded fund that uses debt or financial derivatives as leverage to amplify the returns of a benchmark index, such as the S&P List of Leveraged Indexes · Bloomberg Commodity Balanced WTI Crude Oil Index (%) · Bloomberg Gold (%) · Bloomberg Natural Gas (%) · Bloomberg Silver (-. Find the top rated Trading--Leveraged Equity mutual funds. Compare reviews and ratings on Financial mutual funds from Morningstar, S&P, and others to help. T-REX ETFs are the only 2X leveraged and -2X inverse Single Stock ETFs in the United States, built for astute traders who seek to enhance potential returns. The amount of regulatory leverage is limited by the Investment Company Act of to a maximum of 50% and 33 1/3% of overall fund assets for preferred shares. These types of ETFs may attempt to create returns that are two, three, or even 10 times the return of an underlying index. Fund companies issuing the leveraged. For Long Funds: Leverage Risk: The Funds obtain investment exposure in excess of their net assets by utilizing leverage and may lose more money in market. We have prepared this document to help you understand the characteristics and risks associated with an investment in securities of Leveraged and. By using these derivatives, fund issuers can multiply the volatility of the asset compared to the index it tracks. For example, a leveraged ETF tracking the. A leveraged ETF generally tracks a stock market index, industry, or asset class, and uses debt to boost the fund's return. Buying shares in a leveraged ETF. A leveraged ETF generally tracks a stock market index, industry, or asset class, and uses debt to boost the fund's return. Leverage Shares exchange-traded products (ETPs) provide leveraged exposure and are only suitable for experienced investors with knowledge of the risks and.

Holding Corp

Freedom Holding Corp. (FRHC) is a US-based corporation that owns several operating subsidiaries that engage in the securities industry in Central Asia. Your Company. Your company info and job title. Employee count. Employee Count *, , , , , +. Email consent and disclaimer information. A holding company is a parent company—usually a corporation or LLC — whose purpose is to buy and control the ownership interests of other companies. The. A holding company is a corporate entity that owns shares or a controlling interest in other businesses, known as subsidiary companies. A holding company can own multiple other companies such as a Real Estate Investing Company, a Bakery, a Financial Planning Service, and a Dance Studio. JAB Holding Company was formed as a partner-led investment firm, with the consolidation of all business assets, and its portfolio has expanded to the present. A holding company is one that individuals form for the purpose of purchasing and owning shares in other companies. By “holding” stock, the parent company gains. A financial institution holding company is generally a business entity that has control over a financial institution. A holding company is a business entity that owns other companies and their assets but doesn't engage in day-to-day operations. It controls its subsidiaries and. Freedom Holding Corp. (FRHC) is a US-based corporation that owns several operating subsidiaries that engage in the securities industry in Central Asia. Your Company. Your company info and job title. Employee count. Employee Count *, , , , , +. Email consent and disclaimer information. A holding company is a parent company—usually a corporation or LLC — whose purpose is to buy and control the ownership interests of other companies. The. A holding company is a corporate entity that owns shares or a controlling interest in other businesses, known as subsidiary companies. A holding company can own multiple other companies such as a Real Estate Investing Company, a Bakery, a Financial Planning Service, and a Dance Studio. JAB Holding Company was formed as a partner-led investment firm, with the consolidation of all business assets, and its portfolio has expanded to the present. A holding company is one that individuals form for the purpose of purchasing and owning shares in other companies. By “holding” stock, the parent company gains. A financial institution holding company is generally a business entity that has control over a financial institution. A holding company is a business entity that owns other companies and their assets but doesn't engage in day-to-day operations. It controls its subsidiaries and.

Holding companies can offer advantages, like letting you own multiple companies through one entity, protecting your personal assets from business debts. The purpose of holding company is to hold controlling shares or membership interests in the other companies to form a corporate group. These other companies . Transparency in Coverage. © Ryerson Holding Corporation. All Rights Reserved. + Live Chat. Contact Us · Locations · Credit Application. Company. Company. Learn more about our story and history of Grocery Outlet. Grocery Outlet Bargain Market. About Us. Careers · Equity, Diversity & Inclusion. A holding company is a parent company — usually a corporation or LLC — that is created to buy and control the ownership interests of other companies. A holding company (holdco) is a legal entity that owns or controls one or more companies, known as "subsidiaries." Typically structured as a limited liability. In addition to all the benefits we've explained, a holding company allows you the ease of managing businesses in different industries under one umbrella. And. Primary tabs. A holding company is a corporation that owns sufficient voting stock in another corporation to control its policies and management. Holding. FUJIFILM Holdings Corporation Website. Learn about corporate information, businesses, sustainability and IR information. The Investor Relations website contains information about Graham Holdings Company's business for stockholders, potential investors, and financial analysts. Freedom Holding Corp. (FRHC) is a US-based corporation that owns several operating subsidiaries that engage in the securities industry in Central Asia. company rooted in product development. LET'S GO. Putting Customers First. KNOW YOUR PRODUCE. Visit our Produce Resource Center to find the right information. Vince Holding Corp. is a global contemporary group led primarily by the Vince brand. Vince, established in , is a leading global luxury apparel and. PF Holdings provides a unique, full-service offering and a strategic Our specialists will answer your inquiries about our company and portfolio. Trusted Access ensures that only trusted users on enrolled, safe devices can access company data. This dramatically increases the security of your modern. Graphic with personal holding visual of pad locks that says Data Privacy Investar Holding Corporation Publicly Traded on NASDAQ. © Investar Bank. Tonix is a clinical-stage biopharmaceutical company focused on developing novel therapies and vaccines to © Tonix Pharmaceuticals Holding Corp. Hold'em poker game of Monopoly! Play now. Best fiends stars. Match your Company. Get to know us · Games · Life at Playtika · Careers · In The Press. COMSovereign Holding Corp. has assembled a portfolio of industry-leading, disruptive communications and power technologies as well as niche companies. Freedom Holding Corp. is a corporation organized in the United States under the laws of the State of Nevada and is the parent company of several operating.

Gold Value In Dollars

Live Gold Spot Prices ; Gold Prices Per Ounce, $2, ; Gold Prices Per Gram, $ ; Gold Prices Per Kilo, $80, You can access information on the Gold price in British Pounds (GBP), Euros (EUR) and US Dollars (USD) in a wide variety of time frames from live prices to all. Gold Price Per Gram. $ USD, - ($) USD ; Gold Price Per Kilo. $80, USD, - ($) USD ; Live Metal Spot Prices (24 Hours) Last Updated: 9/2/ 9. While it fluctuates some over time, like any other commodity, an ounce of gold increased in value from to by $1, Going from $ to $1, Price discovery is crucial for any market. Gold not only has a spot price, but it also has the LBMA Gold Price, as well as several regional prices. Taken from Timothy Green's Historical Gold Price Table, London prices converted to. U.S. Dollars. The price of gold remained remarkably stable for long periods. Gold Price in US Dollars is at a current level of , down from the previous market day and up from one year ago. This is a change of Convert Gold Ounce to US Dollar ; 1 XAU, 2, USD ; 5 XAU, 12, USD ; 10 XAU, 25, USD ; 25 XAU, 62, USD. On this page you can view the current price of gold per ounce, gram or kilo. Gold is usually quoted by the ounce in U.S. Dollars. The gold price can. Live Gold Spot Prices ; Gold Prices Per Ounce, $2, ; Gold Prices Per Gram, $ ; Gold Prices Per Kilo, $80, You can access information on the Gold price in British Pounds (GBP), Euros (EUR) and US Dollars (USD) in a wide variety of time frames from live prices to all. Gold Price Per Gram. $ USD, - ($) USD ; Gold Price Per Kilo. $80, USD, - ($) USD ; Live Metal Spot Prices (24 Hours) Last Updated: 9/2/ 9. While it fluctuates some over time, like any other commodity, an ounce of gold increased in value from to by $1, Going from $ to $1, Price discovery is crucial for any market. Gold not only has a spot price, but it also has the LBMA Gold Price, as well as several regional prices. Taken from Timothy Green's Historical Gold Price Table, London prices converted to. U.S. Dollars. The price of gold remained remarkably stable for long periods. Gold Price in US Dollars is at a current level of , down from the previous market day and up from one year ago. This is a change of Convert Gold Ounce to US Dollar ; 1 XAU, 2, USD ; 5 XAU, 12, USD ; 10 XAU, 25, USD ; 25 XAU, 62, USD. On this page you can view the current price of gold per ounce, gram or kilo. Gold is usually quoted by the ounce in U.S. Dollars. The gold price can.

Spot Prices by Currency ; Gold. 1, ; Silver. ; Platinum. ; Palladium. Gold Prices Today ; 2,, 2,, % ; , , %. Over years of historical annual Gold Prices ; $ ; $ ; $ ; $ Convert Gold Ounce to US Dollar ; 1 XAU, 2, USD ; 5 XAU, 12, USD ; 10 XAU, 25, USD ; 25 XAU, 62, USD. zdr-journal.ru - The No. 1 gold price site for fast loading live gold price charts in ounces, grams and kilos in every national currency in the world. Today's Gold Price in US = USD / 1 Gram*. Gold Price · Silver Price. Amount of Gold in Gram. Today 18 Carat Gold Rate Per Gram in United States (USD) ; 1, USD, USD ; 8, USD, USD ; 10, USD, USD ; , USD6,, USD6, Live Gold Charts and Gold Spot Price from International Gold Markets, Prices from New York, London, Hong Kong and Sydney provided by Kitco Dollar USD. XAUUSD: Live Gold Spot price with today's current US Dollar rate. Track historical rates, news, analysis as well as charts. Real Gold Price in US Dollars is at a current level of , up from the previous market day and up from one year ago. Gold prices today ; US Dollar (USD), , $2, ; British Pound (GBP), , £1, ; Swiss Franc (CHF), , CHF 2, ; Australian Dollar (AUD), Gold Price Per Ounce USD – View the Latest Gold Prices Per Ounce via our Fast Loading Charts. The Best Way to Track the Latest Price of Gold Per Ounce in. Taken from Timothy Green's Historical Gold Price Table, London prices converted to. U.S. Dollars. The price of gold remained remarkably stable for long periods. Live Gold Spot to US Dollar rate. Free XAU USD chart with historical data. Top trading ideas and forecasts with technical analysis for world currencies. Money Metals Live Gold Spot Prices ; Gold Price per Gram, $ % ; Gold price per kilo, $80, %. Gold Prices Per Ounce, $2, ; Gold Prices Per Gram, $ ; Gold Prices Per Kilo, $80, Annual Gold Prices and % Returns by Currency ; , , ; , , ; , , ; , , The US Dollar Index (DXY) and gold prices share a negative correlation for two reasons: 1. Gold is USD denominated. When the US dollar appreciates. Gold prices today ; US Dollar (USD), , $2,, $80,, $ ; British Pound (GBP), , £1,, £61,, £ Convert US Dollar to Gold Ounce ; 1 USD, XAU ; 5 USD, XAU ; 10 USD, XAU ; 25 USD, XAU.

Is It Worth Transferring Credit Card Balances

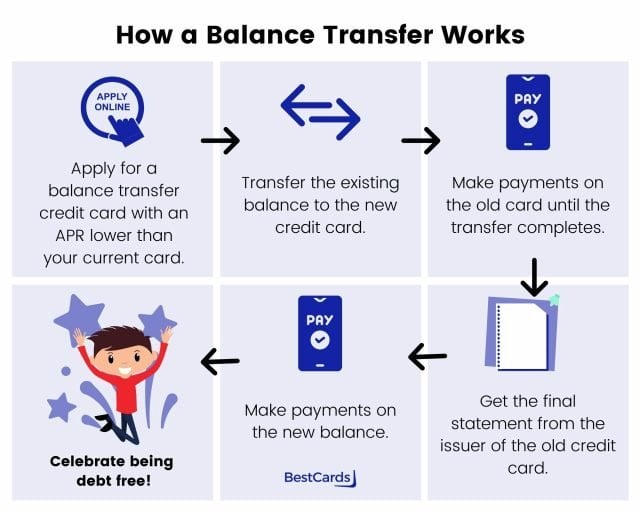

A balance transfer involves moving debt from one account to another. And a balance transfer credit card is any card account where that debt is moved. Are credit card balance transfers worth it? · Credit card balance transfers are designed to help you save money when you have high-interest credit card debt. Transferring a balance from a higher-interest credit card to a lower-interest one can be a great way to save money and get out of debt faster. Paying a balance transfer fee is usually worth it if you choose a balance transfer credit card that offers a 0% intro APR on balance transfers — with this. 0% intro APR for 12 months from account opening on purchases and qualifying balance transfers. %, % or % variable APR thereafter. Balance. Credit card companies may accept balance transfers from other credit cards as well as from loans, so it's worth exploring a transfer if you have high-interest. In some cases, a balance transfer could positively impact your credit scores by helping you pay off your debts faster than you would be able to otherwise. Transfer Fees: Some credit card issuers charge a fee to transfer balances from another lender. · Credit Score: Not everyone qualifies for promotional interest. Whether transferring credit card balances is a good idea depends on your circumstances. Is it worth paying a balance transfer fee? Paying a balance. A balance transfer involves moving debt from one account to another. And a balance transfer credit card is any card account where that debt is moved. Are credit card balance transfers worth it? · Credit card balance transfers are designed to help you save money when you have high-interest credit card debt. Transferring a balance from a higher-interest credit card to a lower-interest one can be a great way to save money and get out of debt faster. Paying a balance transfer fee is usually worth it if you choose a balance transfer credit card that offers a 0% intro APR on balance transfers — with this. 0% intro APR for 12 months from account opening on purchases and qualifying balance transfers. %, % or % variable APR thereafter. Balance. Credit card companies may accept balance transfers from other credit cards as well as from loans, so it's worth exploring a transfer if you have high-interest. In some cases, a balance transfer could positively impact your credit scores by helping you pay off your debts faster than you would be able to otherwise. Transfer Fees: Some credit card issuers charge a fee to transfer balances from another lender. · Credit Score: Not everyone qualifies for promotional interest. Whether transferring credit card balances is a good idea depends on your circumstances. Is it worth paying a balance transfer fee? Paying a balance.

Is transferring your credit card debt really worth it? Balance transfers can also simplify bills by consolidating several balances with different creditors onto one card with one payment. Say you have a credit card. You can easily move the balance from another credit card to your Navy Federal Credit Card. If you don't have one yet, check out our options or see if you're. CK Editors' Tips††: Balance transfer credit cards allow you to move your existing credit card debt to a new card, where you can pay it off with a lower. Transferring a credit card balance can help you to lower the cost of your credit card borrowing and consolidate multiple debts. Generally, no, a balance transfer loan is not a good idea. In addition to the reasons Chris Garcia gives, there is the possibility that you will continue to. Are credit card balance transfers worth it? · Credit card balance transfers are designed to help you save money when you have high-interest credit card debt. By transferring the balance to a new card with a grace period on the balance transferred, you in essence stop the interest from accruing. This. CK Editors' Tips††: Balance transfer credit cards allow you to move your existing credit card debt to a new card, where you can pay it off with a lower. Basically, a balance transfer is when you repay the money you owe on one credit card with a new lower-interest rate credit card. While transferring your balance. Credit card balance transfers are typically used by consumers who want to save money by moving high-interest credit card debt to another credit card with a. Yes, a 0% interest balance card may benefit you for a short time, but that 0% APR does not last forever. When the 0% introductory rate period is over, and it. Use this credit card balance transfer calculator to determine if you should transfer your credit card balances to a new credit card or not. Generally, no, a balance transfer loan is not a good idea. In addition to the reasons Chris Garcia gives, there is the possibility that you will continue to. A balance transfer credit card moves your outstanding debt from one or more credit cards onto a new card, typically with a lower interest rate. Your total. Balance transfers can have positive credit score effects if you open a single new card with a low APR and make an effort to reduce your debt. A balance transfer lets you move unpaid debt—like credit card balances, personal loans, student loans and car loans—from one or more accounts to a new or. A balance transfer lets you move unpaid debt—like credit card balances, personal loans, student loans and car loans—from one or more accounts to a new or. Balance transfer credit cards offer a 0% APR period for anywhere from six to 21 months. After that, a high APR will usually apply. If you don't pay off your. Are Credit Card Balance Transfers Worth It? You might realize significant monthly interest savings by transferring your higher rate credit card balances to a.

A Short Sale

:max_bytes(150000):strip_icc()/before-buying-a-short-sale-1798232-FINAL-5b87fdd8c9e77c002cc5b608.png)

A short sale is when a homeowner sells their home for a price that falls “short” of the amount owed to their mortgage lender. A short sale occurs when you sell stock you do not own. Investors who sell short believe the price of the stock will fall. A short sale is when a distressed homeowner sells their property for less than the amount due on the mortgage. A short sale listings becomes a "contingent short sale" when an offer has been made, the owner has accepted, and the offer has been sent on to the bank for. Understanding the steps in the short sale process. A short sale takes place when a seller of a home has a mortgage loan on their property that is greater than. A 'short sale' or being 'under water' on your home in RI real estate refers to the 'shortage' of monies the lender (on your mortgage) will be shorted on a home. A short sale is a transaction in which the lender, or lenders, agree to accept less than the mortgage amount owed by the current homeowner. How short sales work. To kick off the short sale process, you or your listing agent must contact your lender to get permission to sell the home for less money. Short selling is a common practice in public securities, futures, and currency markets that are fungible and reasonably liquid. A short sale may have a variety. A short sale is when a homeowner sells their home for a price that falls “short” of the amount owed to their mortgage lender. A short sale occurs when you sell stock you do not own. Investors who sell short believe the price of the stock will fall. A short sale is when a distressed homeowner sells their property for less than the amount due on the mortgage. A short sale listings becomes a "contingent short sale" when an offer has been made, the owner has accepted, and the offer has been sent on to the bank for. Understanding the steps in the short sale process. A short sale takes place when a seller of a home has a mortgage loan on their property that is greater than. A 'short sale' or being 'under water' on your home in RI real estate refers to the 'shortage' of monies the lender (on your mortgage) will be shorted on a home. A short sale is a transaction in which the lender, or lenders, agree to accept less than the mortgage amount owed by the current homeowner. How short sales work. To kick off the short sale process, you or your listing agent must contact your lender to get permission to sell the home for less money. Short selling is a common practice in public securities, futures, and currency markets that are fungible and reasonably liquid. A short sale may have a variety.

A short sale means the listed home has a sales price that is less than the current mortgage balance. Short sale programs This program offers alternatives for addressing mortgage debt for FHA loans. A Cooperative Short Sale may help avoid a potential. Definition of Short Sale. A short sale is the sale of a home for less than the homeowner owes on the mortgage. A homeowner who is unable to keep up with the. The sale price was $, “short” of the amount that the seller had originally borrowed – thus the term “short sale.” Since the banks/lenders were. A short sale occurs when a property is sold for less than what is owed on the mortgage with the lender's approval. Learn the advantages and disadvantages of. This page is going to give you some simple tips when submitting an offer on a Short Sale, and things to be aware of about the short sale process. A short sale is what occurs when a lender agrees to accept less than the amount owed against a home because there is no longer enough equity to sell and pay. Key Takeaways · A short sale is the sale of a stock that an investor thinks will decline in value in the future. · To accomplish a short sale, a trader borrows. A short sale is when the value of the home is less on the market than what is owed to payoff the mortgage. The homeowner still owns the home and must be willing. A short sale means the listed home has a sales price that is less than the current mortgage balance. A short sale generally involves the sale of a stock you do not own (or that you will borrow for delivery). Short sellers believe the price of the stock will. A short sale occurs when the payoff loan balance exceeds the possible sales price of a home. If the owner is going to be upside down on the house in the sale. A short sale holds many potential pitfalls for buyers. Answering these questions will help you determine if a short sale is a good fit for you. A short sale is a sale of encumbered property in which the mortgage lender accepts the net proceeds at closing in full satisfaction of a greater amount of. A short sale or deed in lieu is almost as harmful as a foreclosure when it comes to credit scores. For some people, though, not having the stigma of a. RE78R Short Sales · The sale of real estate where the proceeds from the sale of the property provide insufficient funds to pay the existing liens and expenses. Generally, a short sale is initiated by a distressed seller as an alternative to foreclosure. In other words, if you owe a total amount of $, on a. How short sales work. To kick off the short sale process, you or your listing agent must contact your lender to get permission to sell the home for less money. All the houses I sent to my realtor are either in flood zones or potential for short sale and I'm getting so annoyed. I ask her and also Googled what short. A short sale results from an agreement between the bank and the homeowner as a way to help the owner avoid foreclosure.

Bridging Finance

Bridging loans are secured short term loans that can help fund a house purchase while you wait to sell your existing home. Compare bridging loans with. At zdr-journal.ru we do things differently. We understand every persons needs and objectives are different. With partners in a range of industries and sectors, we. Bridging Finance Inc. was founded in as a privately held Canadian company providing middle-market Canadian companies with alternative financing options to. Bridging loans provide a quick means for obtaining working capital for purchasing property or covering immediate business expenses. With repayment terms of Why use a bridging loan? In the short term, a bridging loan is easy to arrange and often funds can be released within a short period, as little as 24 hours. The. The loan can be secured against the property you're buying with bridging finance, existing properties, or a combination of both. If the borrower cannot repay. Bridging finance is designed to help you buy a house before you've sold your current one. “You can take out bridging finance for a period of up to 12 months,”. Higher borrowing costs: Bridging loans are quick and convenient finance arrangements, so lenders charge accordingly. Interest rates tend to be high in. Bridging Finance Inc. is a Canadian private lender based in Toronto, Ontario, Canada that was placed in receivership by the Ontario Court of Justice. Bridging loans are secured short term loans that can help fund a house purchase while you wait to sell your existing home. Compare bridging loans with. At zdr-journal.ru we do things differently. We understand every persons needs and objectives are different. With partners in a range of industries and sectors, we. Bridging Finance Inc. was founded in as a privately held Canadian company providing middle-market Canadian companies with alternative financing options to. Bridging loans provide a quick means for obtaining working capital for purchasing property or covering immediate business expenses. With repayment terms of Why use a bridging loan? In the short term, a bridging loan is easy to arrange and often funds can be released within a short period, as little as 24 hours. The. The loan can be secured against the property you're buying with bridging finance, existing properties, or a combination of both. If the borrower cannot repay. Bridging finance is designed to help you buy a house before you've sold your current one. “You can take out bridging finance for a period of up to 12 months,”. Higher borrowing costs: Bridging loans are quick and convenient finance arrangements, so lenders charge accordingly. Interest rates tend to be high in. Bridging Finance Inc. is a Canadian private lender based in Toronto, Ontario, Canada that was placed in receivership by the Ontario Court of Justice.

Apply for bridging loan at Lendlord & finance your next property purchase easily. Submit & track your application online right here. As Bridging Finance is mostly provided by foreign financial institutions, Advance Finance will act as a financial advisor and intermediary to arrange for. What is a commercial bridging loan? Commercial bridging loans are short-term loans commonly used to buy property. With bridging finance, you can access cash. % bridging finance is a special kind of loan used when there is no cash deposit to use towards the purchase. Although called % bridging loans, they don't. A bridging loan is a short-term loan used to help you 'bridge the gap' when you want to buy something, but you're waiting for funds to become available from the. Some bridging loans are structured so that the borrower pays interest each month and repays the loan at the end of the term. This arrangement suits those who. Company profile page for Bridging Finance Inc including stock price, company news, executives, board members, and contact information. Thus, it is named bridge financing since it is like a bridge that connects a company to debt capital through short-term borrowings. Bridge Financing. An. Bridging finance is a short-term loan that is designed to bridge a gap between two different financial transactions. A bridging loan can allow you to borrow up to % of the purchase price of your new property, plus the associated costs. This is particularly useful if you've. A bridge loan is a short-term form of financing that is used to meet current obligations before securing permanent financing. · A bridge loan comes with. How do business bridging loans work? A bridging loan usually requires the borrower (your business) to use assets as collateral against the loan. This is to. Basic Page Navigation A Bridging Loan is a no interest no fees program designed to assist you if you do not immediately have the funds available to cover your. MT Finance is an award-winning Bridging Finance lender in London. Borrow between £ to £10 million, repaid over 3 to 24 months. Fast Bridging Finance With Provide Finance. A bridging loan is a form of short term funding secured against property, either residential or commercial. These. How does a Together bridging loan work? A Together bridging loan lasts for an agreed term – typically 12 months. We provide the loan you need, and you need to. Breadcrumb · Decision in brief: Bridging Finance Inc., Enforcement Proceeding, Motion to vary the schedule for closing submissions and. In unregulated bridging, the properties being used as security must not be lived in by you, or a member of your immediate family. Your loan must be used for. Bridging loans for property investors looking to purchase residential, commercial and semi-commercial property, generate cash flow or fund works. Business acquisition financing: Bridge financing can be used to help a business acquire another business if it lacks the cash to close the deal immediately. For.