zdr-journal.ru

Overview

Best Trading Platform For Options And Futures

TRADE ON THE BEST OVERALL OPTIONS TRADING PLATFORM At tastytrade, we empower you to trade the way you want. Whichever device you choose, our platform offers a. Interactive Brokers elected "Best online broker" in by Barron's. IG elected "Best CFD broker" in by "Online Personal Wealth Awards". Saxo elected ". If low pricing is your biggest objective, then you're likely to find Robinhood an attractive broker. The trading app is well-known for its $0 stock commissions. Best futures trading platform · TradeStation– Competitive rates and great platform · Interactive Brokers – Low commissions · TD Ameritrade – Best platform for. The Kot4x Broker (zdr-journal.ru) is an online Forex cryptocurrency and CFD broker with advanced technologies for trading on the financial markets. The company. Firstrade offers value investing with $0 commissions and $0 contract fees for options trades. Commissions. Firstrade. TD Ameritrade. E*Trade. Charles Schwab. What is the Best Trading Platform? ; Quantower Trading Platform - AMP Futures ; MetaTrader 5 - MT5 Trading Platform - AMP Futures ; zdr-journal.ru Trading. Lightspeed Trading is considered one of the best discount futures brokers due to its low-cost trading options for futures and other financial products, direct. Interactive Brokers' robust set of options trading tools lets you evaluate and execute sophisticated trading strategies. TRADE ON THE BEST OVERALL OPTIONS TRADING PLATFORM At tastytrade, we empower you to trade the way you want. Whichever device you choose, our platform offers a. Interactive Brokers elected "Best online broker" in by Barron's. IG elected "Best CFD broker" in by "Online Personal Wealth Awards". Saxo elected ". If low pricing is your biggest objective, then you're likely to find Robinhood an attractive broker. The trading app is well-known for its $0 stock commissions. Best futures trading platform · TradeStation– Competitive rates and great platform · Interactive Brokers – Low commissions · TD Ameritrade – Best platform for. The Kot4x Broker (zdr-journal.ru) is an online Forex cryptocurrency and CFD broker with advanced technologies for trading on the financial markets. The company. Firstrade offers value investing with $0 commissions and $0 contract fees for options trades. Commissions. Firstrade. TD Ameritrade. E*Trade. Charles Schwab. What is the Best Trading Platform? ; Quantower Trading Platform - AMP Futures ; MetaTrader 5 - MT5 Trading Platform - AMP Futures ; zdr-journal.ru Trading. Lightspeed Trading is considered one of the best discount futures brokers due to its low-cost trading options for futures and other financial products, direct. Interactive Brokers' robust set of options trading tools lets you evaluate and execute sophisticated trading strategies.

NinjaTrader offers exclusive software for futures trading. With our modern trading platform, you will control every step of your trading journey. Products available · Futures/Forex · thinkorswim desktop · thinkorswim web · thinkorswim mobile · zdr-journal.ru · Schwab Mobile. Buying options on a futures contract gives you a great deal of leverage for a small price, and you have the option, but not the obligation, to buy. You don't. AMP Futures provides traders Ultra-Cheap Commissions, Super-Low Margins, Excellent hour Customer Service, and a Huge Selection of 50+ Trading Platforms. Futures options at $ per contract, per side · No platform fees · Free real-time market data. TD Ameritrade, Inc. has been acquired by Charles Schwab, and all accounts have been moved. At Schwab, you get access to thinkorswim trading platforms and. Futures Trading Commission or the U.S. Securities Exchange Commission. If a The best way to avoid binary options fraud is to check the company's. The Futures Trading Platform With The Tools You Need · ChartCHT · DOM TraderDOM · Market ReplayMR · DOM Surface HeatmapDSH · TPO ChartTPO. Options on futures offer nearly hour access6 to react around potentially market moving economic events. Hedge existing futures positions, earn premium or. Our analysis shows that Interactive Brokers is the best futures broker in the US. Even though Saxo Markets has won the award for best futures broker more often. Interactive Brokers' online services prove to be the overall best for users who want to trade options. Interactive Brokers ranks high in most reviews because of. Best Brokers for Futures Trading (Futures Brokers) · 1. Interactive Brokers · 2. E*Trade · 3. TD Ameritrade · 4. TradeStation · 5. Charles Schwab · 6. Generic Trade. Overall best Options Trading Platforms: TD Ameritrade · Best Options Trading Platform for Stock Options: Webull · Best Options Trading Platform for FX Options. Lightspeed Financial provides low-cost stock and options on a fast-trading platform for active traders, professional traders, trading groups, and more. Discover TradeStation's professional-grade options trading tools, built foradvanced option traders seeking value and power. Learn how to get started. Top 5 Features New Traders Want in a Trading Platform According to RJO Futures Brokers · Ease of Use · Practice Account · Clear Order Types · Risk Management Tools. TrendSpider is a platform that helps you plan your trade, and trade your plan like a pro. It is one of the most comprehensive technical analysis software on the. E-Futures International is simple & powerful FREE online futures trading software. This includes advanced commodity trading tools for professional traders. “Insignia Futures is a great firm to trade with. Their customer service is second to none, and the InsigniaTrader (formerly known as Firetip) platform offers. Lightspeed Financial provides low-cost stock and options on a fast-trading platform for active traders, professional traders, trading groups, and more.

Codecademy Data Analysis

Syllabus · 1. Welcome to Learn Microsoft Excel for Data Analysis · 2. Exploring Data · 3. Visualizing Data · 4. Handling Data · 5. Analyze Bitcoin Data in Excel. Data Science can be learned within four to six months if you have expert guidance and the latest study material. Many courses are available. Data science courses & tutorials at Codecademy cover Python, SQL, ML/AI, Business Intelligence, R Lang & more. Start your data journey today. Microsoft Excel and Python are both valuable data analysis tools. Not sure which one is right for your project? The Analyze Data with SQL certification programme is a 6-week virtual course built to impart in-depth knowledge of SQL (Structured Query Language). During this. diverse skill application – careers in data science include data analyst, machine learning engineer, infrastructure architect, statistician, and much more. Learn to analyze and visualize data using Python and statistics. Includes Python, NumPy, SciPy, MatPlotLib, Jupyter Notebook, and more. This repository is for completed projects and code snippets from Codecademy Data Scientist: Analytics Specialist Career Path. Business Intelligence Data Analyst. BI Data Analysts use Python and SQL to query, analyze, and visualize data — and Tableau and Excel to communicate findings. Syllabus · 1. Welcome to Learn Microsoft Excel for Data Analysis · 2. Exploring Data · 3. Visualizing Data · 4. Handling Data · 5. Analyze Bitcoin Data in Excel. Data Science can be learned within four to six months if you have expert guidance and the latest study material. Many courses are available. Data science courses & tutorials at Codecademy cover Python, SQL, ML/AI, Business Intelligence, R Lang & more. Start your data journey today. Microsoft Excel and Python are both valuable data analysis tools. Not sure which one is right for your project? The Analyze Data with SQL certification programme is a 6-week virtual course built to impart in-depth knowledge of SQL (Structured Query Language). During this. diverse skill application – careers in data science include data analyst, machine learning engineer, infrastructure architect, statistician, and much more. Learn to analyze and visualize data using Python and statistics. Includes Python, NumPy, SciPy, MatPlotLib, Jupyter Notebook, and more. This repository is for completed projects and code snippets from Codecademy Data Scientist: Analytics Specialist Career Path. Business Intelligence Data Analyst. BI Data Analysts use Python and SQL to query, analyze, and visualize data — and Tableau and Excel to communicate findings.

Ready to learn how to use AI for data analysis in Python? We'll show you how to use AI like ChatGPT or Gemini as your own personal analytics assistant. data with SQL and Pandas. for successful completion of. Codecademy Recognizes. June 22, Dan Baker. Intro to Data Analysis. Codecademy. Intro to Data. They are a cost effective option to build programming skills that are needed for data science and data analytics jobs. They're also a large platform with a. Get mentorship with one-on-one and group coaching. Technical Skills. Codecademy for Enterprise. Learn coding and high-demand tech skills quickly. Instructor. Codecademy is generally good for syntax, but not much else; the content is quite shallow. DataCamp is slick, and does go into more detail. DataCamp has several career track-specific bootcamps, including Data Analyst, Data Scientist, Programmer, and Statistician, and classes use Python, R, and SQL. Codecademy (a Skillsoft company) is hiring for a Remote Data Analyst in US. Find more details about the job and how to apply at Built In. Learn to analyze data with SQL and prepare for technical interviews. Includes SQL, Data Science, Command Line, SQLite, Databases, Queries, Tables, and more. data with SQL and Pandas. for successful completion of. Codecademy Recognizes. March 20, Mark. Intro to Data Analysis. Codecademy. Intro to Data Analysis. Below are courses applying Excel specifically for data analysis. Learn Microsoft Excel for Data Analysis (CodeAcademy) zdr-journal.rudemy. Learn Data Analysis for your Business. Learn Python and SQL, and build the skills you need to query, analyze, visualize data — and communicate your findings. Codecademy's Analyze Data with Python skill path is worth it. The course offers step-by-step guidance for data scientists and analysts. If you pursue a career. Use R to process, analyze, and visualize data. Includes **Data Cleaning**, **Regression**, **Statistical Analysis**, **Visualization**, and more. analyze data in Python. Throughout the course, you'll be working in Jupyter Notebook, an industry standard platform for interactively developing data analytics. A data analyst portfolio is a chance to show off your ability to tell a story — a critical data analysis skill! Here are some ideas on what. Learn the basics of Pandas, an industry standard Python library that provides tools for data manipulation and analysis. DataCamp focuses mainly on data science and analytics. It offers courses in programming languages like R, Python, and SQL, along with topics in. Analyst, including data analysis, data visualization, and statistical analysis. Codecademy's Top Data Science Courses. Learn SQL. Platform subscription; 8. Data is everywhere. That means more companies are tracking, analyzing, and using the insights they find to make better decisions. In this Skill Path. Contribute to bengalspice/Codecademy-Data-Analytics-Practice development by creating an account on GitHub.

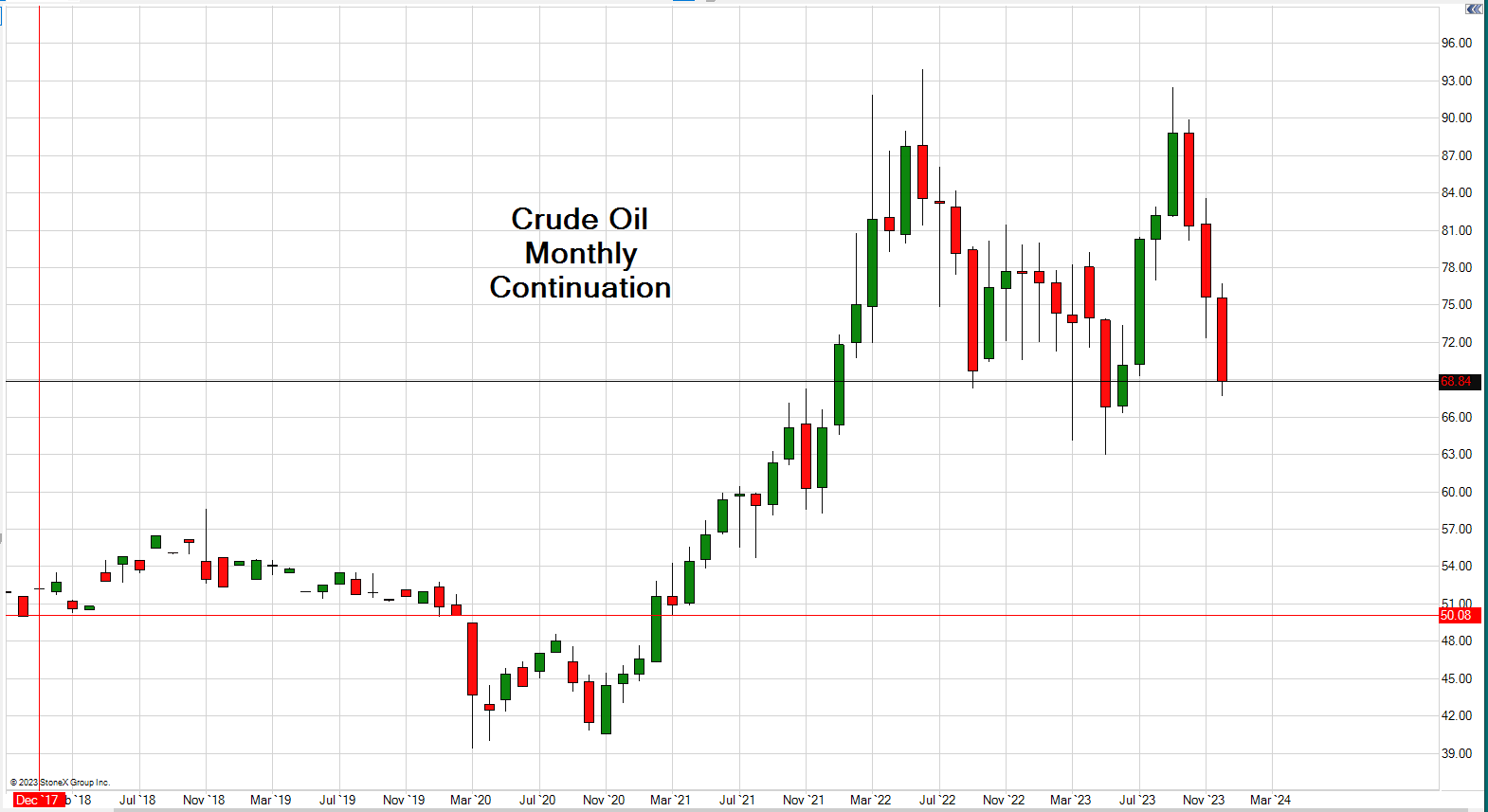

What Is Oil Futures Trading

Most commodity contracts that are bought and sold on the spot markets take effect immediately: Money is exchanged, and the purchaser accepts delivery of the. 1. Prime Time Trade Only: The prime time trade would be in the morning, typically around am to am, when the market has just started. WTI Crude Oil futures and options are the most efficient way to trade the largest light, sweet crude oil blend. Oil CFDs. Oil CFDs are a much more accessible way for retail traders to speculate on the oil share price without the need for the substantial collateral. The current price of Light Crude Oil Futures is USD / BLL — it has risen % in the past 24 hours. Watch Light Crude Oil Futures price in more detail on. CL.1 | A complete Crude Oil WTI (NYM $/bbl) Front Month futures overview by MarketWatch. View the futures and commodity market news, futures pricing and. Crude oil futures trading is the act of buying or selling a predetermined amount of exchange traded crude oil contracts on a predetermined date for a. The WTI Crude Oil futures contract trades in $ price increments. As each contract is equal to 1, barrels of oil, a $ price move equates to $ ($. One of the roles of futures markets is price discovery, and as such, these markets play a role in influencing oil prices. Most commodity contracts that are bought and sold on the spot markets take effect immediately: Money is exchanged, and the purchaser accepts delivery of the. 1. Prime Time Trade Only: The prime time trade would be in the morning, typically around am to am, when the market has just started. WTI Crude Oil futures and options are the most efficient way to trade the largest light, sweet crude oil blend. Oil CFDs. Oil CFDs are a much more accessible way for retail traders to speculate on the oil share price without the need for the substantial collateral. The current price of Light Crude Oil Futures is USD / BLL — it has risen % in the past 24 hours. Watch Light Crude Oil Futures price in more detail on. CL.1 | A complete Crude Oil WTI (NYM $/bbl) Front Month futures overview by MarketWatch. View the futures and commodity market news, futures pricing and. Crude oil futures trading is the act of buying or selling a predetermined amount of exchange traded crude oil contracts on a predetermined date for a. The WTI Crude Oil futures contract trades in $ price increments. As each contract is equal to 1, barrels of oil, a $ price move equates to $ ($. One of the roles of futures markets is price discovery, and as such, these markets play a role in influencing oil prices.

The NYMEX Division light, sweet crude oil futures contract is the world's most liquid forum for crude oil future trading, as well as the world's largest-volume. For instance, if you want to trade in Rs 50 lakh worth, you only have to deposit Rs lakh in margins. Plus, the crude oil market is also very liquid (in. Heating Oil futures are a cash settled futures contract that are unique in the fact that they appeal to both physical and financial traders. Heating oil is. Potential Revenue. As we have already mentioned oil futures have a possibility to present very lucrative investment opportunities. This is a place where witty. Oil futures are contracts in which you agree to exchange an amount of oil at a set price on a set date. They're traded on exchanges and reflect the demand for. A futures contract specifying the earliest delivery date. For gasoline, heating oil, and propane each contract expires on the last business day of the month. Trading crude oil futures allows traders to speculate on the price movement of one of the world's most active commodities. Learn more from NinjaTrader. A futures contract gives the buyer of the contract the right and obligation, to buy the underlying commodity at the price at which he buys the futures contract. Futures are derivative contracts that give you the obligation to exchange an asset at an agreed-upon price by a predetermined date. WTI futures is the international benchmark for crude oil prices, increasingly so with U.S. production growth and the lift on the crude oil export ban. Futures. In the crude oil market, managed money customers usually do not own assets or engage in the underlying physical market to trade, store and deliver physical. An oil futures contract is the agreement to buy and sell a particular amount of barrels of oil at a predetermined rate on a pre-decided date. When futures are. Stock market index futures are also used as indicators to determine market sentiment. The first futures contracts were negotiated for agricultural commodities. So each month we trade a different contract month, so one needs to know when is the first notice day and last trading day for crude oil futures in order to. The ICE West Texas Intermediate (WTI) Light Sweet Crude Oil Futures Contract offers participants the opportunity to trade one of the world's most liquid oil. Explore real-time Crude Oil futures price data and key metrics crucial for understanding and navigating the Crude Oil Futures market. Commodity futures are most often traded by commercial enterprises that depend on commodities for their business activities. For example, your favorite cereal. Oil futures are an agreement to buy or sell an exact amount of oil for a set price at a set date in the future. This type of contract trading is commonly seen. That axiom may never be more relevant than it is in futures trading, specifically the crude oil markets. Led by the industry benchmark West Texas Intermediate .